THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

Normally when we look at the Fed’s balance sheet, we discuss its assets: Treasury securities, MBS, repurchase agreements (repos), swaps, SPVs, etc. Under the new regime of Quantitative Tightening (QT), total assets have dropped by $139 billion from the peak, as of its balance sheet released on September 1.

But it’s the liabilities that limit how far the Fed’s assets can theoretically drop under QT. By looking at the path of those liabilities, we can project the theoretical bottom of QT, below which the Fed cannot go.

On every balance sheet, total assets = total liabilities + capital.

Capital is easily dispensed with: The amount of capital is capped by Congress. Total capital is currently $42 billion, which is minuscule, but that’s how Congress wants it. So be it.

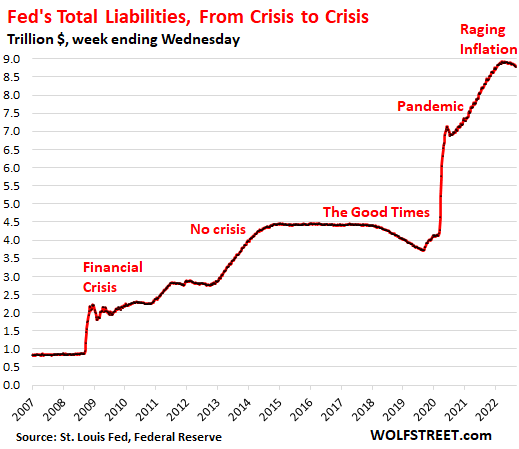

Total liabilities: $8.78 trillion, down by $139 billion from the peak on April 13. Liabilities are what the Fed owes other entities. We’re going to look at the four largest liabilities, which account for nearly all of the liabilities:

Total liabilities parallel total assets, the only difference being the minuscule amount of capital. But the composition of those liabilities has changed dramatically, as we’ll see in a moment:

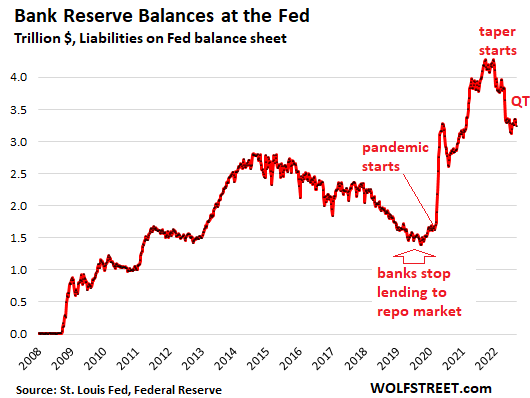

Reserve balances peaked in December 2021, after the Fed had begun reducing its asset purchases. Since then, reserve balances have plunged by $1.03 trillion, including by $59 billion over the past week:

“Reserves” are cash that banks put on deposit at the Fed. Banks use their reserve accounts at the Fed to transfer money to and from other banks. They’re a liability on the Fed’s balance sheet because they’re money that the Fed owes the banks. Banks on their own balance sheets carry them as assets, and don’t call them “reserves” but “interest-earning deposits,” or similar.

The Fed currently pays 2.4% interest on reserves; they are the most liquid, risk-free interest-paying asset banks can invest in, and they also figure into the banks’ regulatory capital.

Alternatively, banks could invest some of this cash in short-term Treasury securities (Treasury bills). The one-month Treasury yield was 2.49% on Friday. But Treasury bills provide less liquidity than reserves. Banks could also send cash to the Fed via overnight RRPs, but the Fed only pays 2.3% on RRPs.

Reserves are a manifestation of liquidity in the banking system that is now not chasing after other assets.

QE created liquidity that then went chasing after all kinds of assets and drove asset prices higher.

QT drains liquidity from the financial system, and generally speaking, one of the aspects of this liquidity being drained is a drop in reserves.

But the $1-trillion plunge in reserves, after only $139 billion in QT, is due in part to a shift to RRPs via Treasury money market funds. More in a moment.

As QT plows forward, reserve balances are going to shrink further. How far can they shrink? We have some history on this.

Under the last QT regime from Nov. 2017 through Aug. 2019, reserves dropped as expected. But when they hit a low of $1.4 trillion in September 2019, the banks stopped lending to the repo market. They had reasons because overleveraged mortgage REITs and some hedge funds that were borrowing in the repo market short term to fund long-term bets were beginning to blow up. Fearing contagion from the huge repo market, the Fed stepped in and bailed it out.

It then said that its monetary policy is based on an “ample reserves regime,” a floor of sorts, meaning it wants banks to have “ample” cash on deposit at the Fed. It didn’t mention a figure, but it phased out its repo market bailout once reserves reached $1.6 trillion.

In preparation for QT, the Fed last summer revived its “standing repo facilities” that it used to have before the Financial Crisis, but shut down as QE commenced in 2008. These SRFs for repos and reverse repos allow the Fed to step in real time if the repo market threatens to wobble. So this one is likely not going to blow out again.

So what are the minimum reserves under the “ample reserves regime,” combined with the safety feature of the SRF?

We will find out, and it could be less than $1.6 trillion because of the safety feature. But let’s stick for now with $1.6 trillion as the minimum.

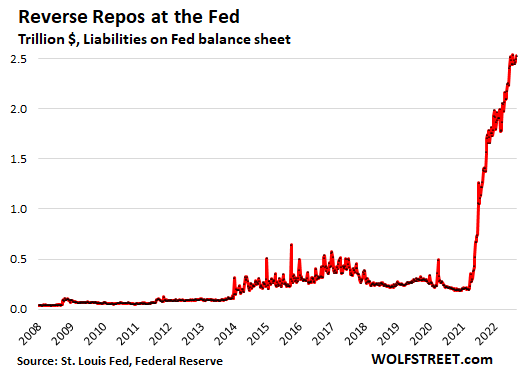

Under these contracts, the Fed takes in cash and hands out collateral (Treasury securities). They’re a liability because it’s money that the Fed owes its counterparties. The Fed pays 2.3% in interest on this cash.

The Fed offers two groups of reverse repurchase agreements, and both combined total $2.53 trillion:

Total RRPs started spiking in April 2021, but since June 2022, have been roughly stable in the $2.5 trillion range.

The overnight RRPs, currently $2.25 trillion, are cash from Treasury money-market funds.

Starting early last year, Treasury money market funds got flooded with cash. They normally would buy Treasury securities with short maturities, but demand was so high that short-term yields dropped to 0% and briefly below 0%. A negative yield is a problem for money market funds because it might cause them to “break the buck,” where a unit’s value might drop below $1, which could trigger a run on the fund, which could spiral out from there, which is why the Fed started offering RRPs, and then started paying interest on them.

And there’s now another reason for the surge in RRPs: Treasury money market funds have started to shift their short-term cash that they need to keep on hand to RRPs, from their bank accounts, because the Fed pays higher interest on that cash. In addition, RRPs offer essentially zero credit risk, which is not the case with large bank account balances.

What this means for the Fed’s balance sheet: A shift from reserves to RRPs, and this could explain why reserves plunged by $1 trillion over the past 8 months, as RRPs have shot higher.

In theory, they can drop to near-zero as liquidity is wrung from the system via QT. There is no reason for the Fed to maintain a minimum balance of RRPs. This is demand based, and as other interest rates rise and liquidity vanishes, RRPs could drop to very low levels four years from now. So for our theoretical minimum, let’s say this is near $0.

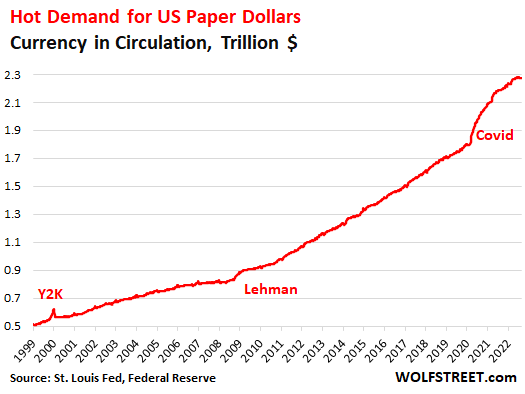

Currency in circulation – the paper dollars in your pocket, aka Federal Reserve Notes – is demand based through the US banking system. If customers demand paper dollars at the ATM or at the counter, the bank must have enough on hand. In other countries, foreign banks have relationships with US banks to provide paper dollars to their customers.

US banks get those paper dollars from the Fed in exchange for collateral, such as Treasury securities. In other words, as demand for paper dollars rises, banks must get more paper dollars from the Fed, and to get them, must post more collateral at the Fed. As the liability of currency in circulation increases, the collateral, such as Treasury securities, also increases the assets on the Fed’s balance sheet.

Before QE, currency in circulation was the primary driver of the increase in assets on the Fed’s balance sheet. And demand has been huge – but not for payment purposes.

Paper dollars are stashed under mattresses, in vaults, and in suitcases around the world. When there is a crisis – or a potential crisis, such as Y2K – in the US, people stock up on paper dollars.

Currency in circulation, after spiking throughout the pandemic, started leveling off in early July, and has now inched down a tad, to $2.28 trillion:

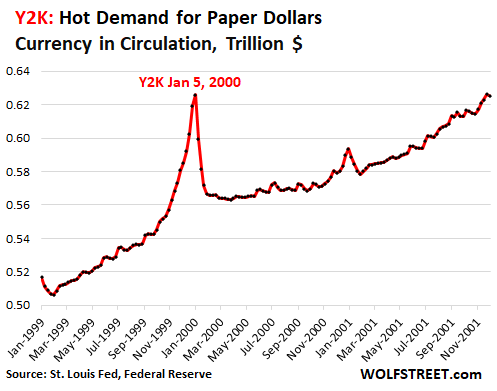

Remember Y2K? Which was a dud. But everyone stocked up on paper dollars, and demand spiked, and after the dud, the extra cash went back to the Fed via the banks:

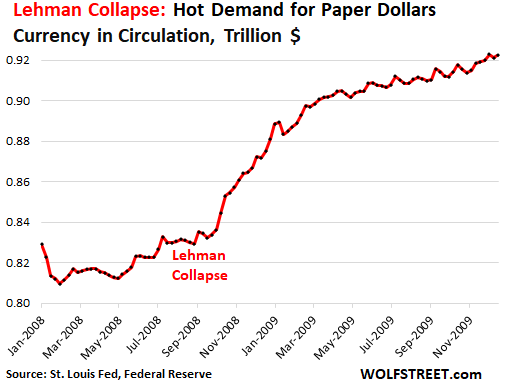

The bankruptcy of Lehman Brothers in September 2008, which opened up the long-brewing Financial Crisis for all to see, sent people to ATMs, pulling cash out just in case. By late 2009, this was starting to normalize again:

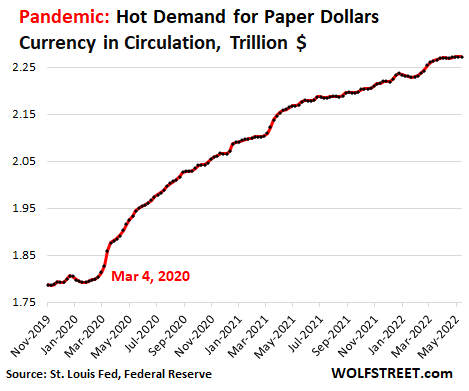

During the pandemic, there was huge demand for cash. Between late February 2020 and December 2021, currency in circulation spiked by 25%. There is some chance that some of this could unwind:

Each time there is an increase in currency in circulation, the Fed’s asset increase by the amount of the collateral that banks post to get the paper dollars.

A four-year decline in currency in circulation, as customers take paper dollars back to the bank, though theoretically possible, seems unlikely in normal times.

Instead, over the next four years, I expect currency in circulation to increase at the pre-pandemic rate of about $100 billion per year, thereby adding about $100 billion per year in collateral to the Fed’s assets. So four years from now, we might be looking at $2.7 trillion in currency in circulation.

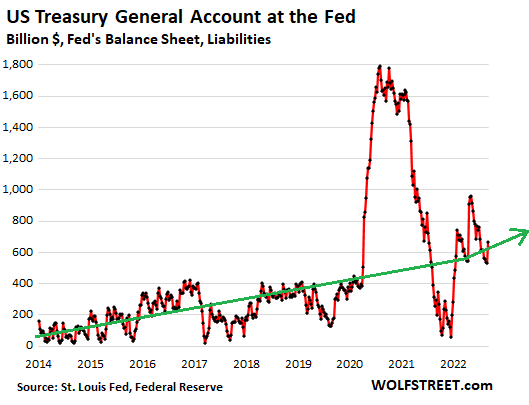

The government’s checking account is with the Federal Reserve Bank of New York. The amount that the government has on deposit there is a liability for the Fed because it’s money that the Fed owes the government.

The level of deposits has been swinging wildly, driven by protracted debt-ceiling fights when the government nearly runs out of cash before Congress relents, and by the government’s super-massive debt issuance early on in the pandemic to pay for the stimulus programs. That debt issuance raised a huge amount of cash that took a while to draw down.

And now there is a new element: Raging inflation, which drives up outlays and revenues. Over the years, as larger amounts flow through the checking account, the average balance will likely increase to accommodate the larger flows.

As of the Fed’s balance sheet released on September 1, the government had $670 billion on deposit at the Fed. The green line represents the pre-pandemic trend of the increase of the account balance on average. I made a kink into the green line, starting early 2021, when raging inflation kicked off to show the long-term trend under much higher inflation.

Given the erratic nature of these TGA balances, I’m going to go out on a limb and estimate that the average balance in fours years might be around $800 billion.

In summary, four years from now, the floor of the Fed’s total liabilities would be at $5.2 trillion:

So four years from now, based on these estimates, the floor for total assets on the Fed’s balance sheet would be about $5.2 trillion, below which the Fed could not go. At the peak, the Fed had $8.97 trillion in assets. So my calculus says that the Fed could do a maximum QT of about $3.8 trillion.

This would be a huge reduction in liquidity, and it would sack asset prices. That’s why QT is loathed when its effects become apparent. Look how asset prices have been sagging, and QT has barely started. And something big might blow up before the Fed even gets to the theoretical floor.

If inflation continues to rage, paper dollar holders may get tired of getting mauled, and they might convert those paper dollars into interest-paying assets. If that happens, there could be a significant decline in currency in circulation, and therefore in collateral, that would pull down the Fed’s assets further and would provide for a lower floor.

Decades of relatively low inflation minimized the cost of holding paper dollars, but now that cost is spiking. We might already be seeing some of it because over the past few months, currency in circulation has actually dipped. If this is a trend in the making, a lot of these Federal Reserve Notes might be going back to the Fed, further reducing both sides of the balance sheet, and lowering the floor below which the Fed cannot go.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

All I see is just a pitiful, piss-poor performance by a central bank which decided to print money to make the rich richer, and destroyed pricing in the process.

OK, now that you got this off your chest, go ahead and read the article.

I did read it. All of it. I found the paper dollars part most interesting. I just have become horribly cynical over the FED and my comment entered “broken record” territory. I will do better next time.

This is an important article.

Asset prices for the last decade have been driven almost exclusively by Fed QE. That is now over.

This article offers a clue for when we might expect the bottom in asset prices, which won’t occur until the Fed changes direction. I sincerely hope this will become a recurring feature from Wolf.

This is a very informative article. Let me apply my own probabilistic tuning on it.

There seems no reason for both govt and people to hold cash as inflation will remain high for years as we are not productive enough to even sustain our debt and need inflation to dilute it.

So I say that TGA floors to 300 Billion and Currency in circulation to 1 trillion.

If Fed does stick to QT in principle, overleveraged funds will blow up soon as assets will correct significantly. So banks can then reduce reserves to $1 Trillion.

With this Fed assets can reduce to $2.4 trillion.

Sounds like a circle jerk to me.

“The Fed currently pays 2.4% interest on reserves”

Borrow money, buy bonds, swap bonds, park money, all at high interest rates. Not 18% like we pay but lucrative.

I feel like Wolf is just scratching the surface here.

Currency in circulation has a huge portion overseas / outside the US.

It’s held for many reasons, including that the US is more inflation-resistant than most other countries.

Factoring in recent exchange-rate changes, dollar-holders overseas are doing much better than if they were holding strictly local currencies.

We have also seen many occasions where electronic bank accounts and credit cards can’t be used (power outages), or political events cause accounts to get confiscated or frozen. (Just ask Canadian truck drivers…). Dollars in your mattress are immune to any of those shenanigans and are nearly as good as gold for preserving wealth in a portable format.

So long as the Fed maintains QT and defends the dollar against inflation, I really doubt that Currency in Circulation will drop significantly.

I really loved this article. I never really thought about the other side of the balance sheet, but it tells alot.

So my understanding of this is that during the initial market reaction to the pandemic the market was selling everything including Treasuries. The Fed stepped in and bought massive amounts of Treasury debt and took all the risk. In addition, the RRPs are also another way of the Fed basically back-stopping the value of Treasury debt by giving a guaranteed rate of return and taking the interest rate risk.

My question is doesnt this create some form of long term imbalance in the amount of interest they are paying versus the amount they are earning? And to take this further, if the Fed was forced to mark to market the value of the Treasuries it has purchased, wouldnt it need to take very large losses on those bond purchases since the value of the bonds has tanked relative to the price they can sell them at? So as the Fed rolls off the bonds it purchased during the pandemic (at incredibly low interest rates) doesnt it actually lose money on the sale of those bonds?

Is this is reason the Fed can really only roll off a small amount of debt, instead of selling this stuff really fast? I understand that if the Fed is holding the debt until expiration then it doesnt take a loss, and if they bought very short term debt primarily, then they can just let alot of it roll off, or take very small losses, since the loss on a short dated Treasury is much less than the loss on a long term Treasury.

So the question also becomes whether the Fed is planning that in order for them to not suffer horrible losses they would need to see interest rates fall in the future?

Who pays for those losses? If the capital of the Fed is incredibly low, an accounting of the value of the assets versus the liabilities would

Gametv,

I’m gonna go backwards, from the bottom up.

“Who pays for those losses?” — The Fed can create its own money, so it cannot fail. It can and will set up any losses as an asset account (in corporate accounting, this would be “goodwill” or “intangible assets” or some such thing), and then amortize it in the future when it is showing income again. Or not amortize it and just keep carrying it.

“forced to mark to market” – Even commercial banks have two options: 1. securities held to maturity are not marked to market. 2. Securities held for sale are marked to market.

The Fed doesn’t follow bank accounting (it follows “central bank accounting”), but doesn’t have to mark to market anything because it doesn’t hold securities for sale.

If it does sell some those securities, it would take some loss on some of them, but it would be small compared to the huge size of the Fed’s interest-earning assets. The Fed earns a LOT of interest income from those securities — $123 billion last year — and any capital loss or operating loss would first ago against the interest income.

If it books a net loss for the year, it will not remit anything to the Treasury Dept (it remitted $107 billion to the Treasury Dept last year). So that’s money that taxpayers are NOT getting anymore for a while.

And it will set up an asset account (similar to goodwill in corp accounting when they overpay for something) to carry the loss. This way, the loss won’t hit capital.

Yes, the Fed has created all kinds of long-term imbalances – but paying interest on reserves is not the big issue. QT is going to unwind some of those imbalances. Paying interest on reserves keeps that cash at the Fed and out of the hands of the markets, and so that limits some of the imbalances. Enough QT will reduce that problem by a lot.

thanks for that Wolf. I went and researched a little and found that as you said if the Fed incurs losses it will merely put those on the balance sheet as an asset and since noone is auditing the Fed for solvency, there wont be any reckoning.

one other point i found is that the Fed earns interest on the treasury bonds it holds, but no interest on the currency it issues, so it always has the interest rate differential to fall back on. so even with large losses, it will merely need to earn them back over a period of time.

i guess the Fed survives no matter what unless the demand for dollars plummets. The bitcoin crowd has always argued that the profligacy of the Fed is a reason to hold Bitcoin, and for a short while I agreed with that thesis, but then I realized that although Bitcoin is limited the number of cryptos that can be created in total is infinite and there is little good reason that only one will exist, hence crypto is probably more likely to decline based on a lack of true scarcity.

Plenty of central banks will become technically insolvent as the declining value of their assets creates negative equity.

It might (and probably will) become an embarrassment at some point which they hate, but no one can force any central bank into bankruptcy. A central bank can only be abolished by the government.

Wolf, you said “Fed… doesn’t have to mark to market anything because it doesn’t hold securities for sale.”

however, it holds $2+T of MBS which are securities for sale, right? I mean they’ve been trying to sell them early but Mr. Market refuses to buy them (toxic waste). So, please explain why the Fed would never have to mark MBS to market should housing prices collapse (thus foreclosures soar) long before the MBS maturity dates?

TIA.

Hey Wolf, fantastic read:

May I suggest:

1) If RRPs are the new go-to for current accounts holding dollars, then the floor might not be zero, say if the fixed income funds manage 50 trillion dollars and 2% has to be maintained as liquidity, that would give us a 1 trillion floor.

2) Do banks have to get back to 1.6 if a lot of their former customers are parking in rrps instead of bank accounts? Does this increase bank instability by reducing the deposits held at banks without reducing the loans given out by those banks?

3) Does every dollar taken out of the banks and put into rrps have a multiplier effect by way of the reserve ratio banking system?

4) Where does the Government deficit come into this? If they are spending say 100 bill a month extra, that volume has to be financed by bill issuance. Those bills must either be absorbed by the market, via a reduction in cash, or bank reserves, or rrps. ofcourse it finds its way back into bank reserves so is deficit spending actually stimulative?

Trying to figure out where the asset bubble starts losing steam. (so far I think that we have tanked on fears of this but not the actual reduction of volume of money)

Concerning your #1: yes, that’s a possibility. Powell alluded to the potential for cash that would have ended up in reserve balances ending up in RRPs, and if that happens on a large enough a scale, he seemed to say, then the “ample reserves regime” might no longer be needed, or be needed to a lesser extent, and reserves might be allowed to drop more than I anticipate. I hate to even bring this up – and I didn’t in the article – because it’s all just “alluded to” kind of stuff. But it would make sense to see a shift of this type.

But the cash-on-hand that MM funds need to have is not huge. So it’s not like this gigantic pile of money. So once they put all their to-be-invested cash back into Treasuries, their cash-on-hand at the RRPs wouldn’t be a huge amount.

The math doesn’t add up. Unless of course we are doing common core. Prior to 2008 using your figures doesn’t support why we would need the figure that was being held at $5T. Reverse repo and MBS

Nathan Dumbrowski,

Since YOU cannot do even basic math apparently, here it is again from the article. You can use your fractional fingers to add them up:

In summary, four years from now, the floor of the Fed’s total liabilities would be at $5.2 trillion:

Reserves: $1.6 trillion

RRPs: near $0

Currency in Circulation: $2.7 trillion

TGA: $800 billion

Other liabilities beyond the big four: $50 billion

And if you didn’t read the article, don’t comment about the article or about what you imagine the article said. Commenting guideline #1

Thanks Wolf. The post clipped my response. Basically I had asked how we were able to function prior to the 2008 financial crisis without accounting for the currently in circulation. That is half the figure you have mentioned. Thanks for the reply.

This is a good question. Simple answer: Before 2008 financial crisis Fed was not in the business of bailing out big investors at the expense of tax payers.

So there wasn’t crap loans that needed to be backed by assets. For e.g. Wolf says that banks stopped lending to speculators when reserves fell below $1.4 trillion. The only reason banks have to keep these large reserves now is because they are now lending to speculation in exchange for “funny money” collateral instead of real assets.

This is what happens when you paint yourself into a corner, or in our case, were lured into the vault seeking a cask of Amontillado.

So ,Wolf,the reduction of notes in circulation might add to a liquidity squeeze, at some unknown trigger point? It would seem that QT has unknowable pitfalls? Some part of the system might blow up? Like ,SUDDENLY?

“Some part of the system might blow up? Like ,SUDDENLY?”

Yes, there’s a chance. But I don’t think it would be related to currency in circulation. I’m more in the camp of a huge hedge fund or PE firm blowing up and contagion spreading from there.

Wold, re ” I’m more in the camp of a huge hedge fund or PE firm blowing up and contagion spreading from there.”

Is it likely that China hard landing and/or a sudden Yuan devaluation blow up some too big to fail trading desk? I seem to recall bad high leverage currency bet taking down many firms.

However, it was rumored (not sure if ever proven) that the massive repo (“not QE”) operations the Fed did in (~2018?) was a hidden/back door bailout of a systemic trading desk about to fail. So, is that all the Fed has to do to always avoid another GFC?

Since the total assets are now at $8.83T and they can only drop to about $5.2T then:

$8.83T – $5.2T=$3.63T left of QT

Given the $95B of QT now that the phase in is over, there would be:

$3.63T / $95B = 38.2 months or 3 years and 2.2 months left of QT at this pace to get down to $5.2T.

The question is will the Fed keep the QT rate of $95B per month and will they continue for the next 3.2 years? Has the Fed indicated that this is actually their plan? Would the Fed only deviate from their plan if the banks were in trouble regardless of the stock market and housing crashes?

Yes, but just a little tweak: the $95 billion is the cap, the max per month. Two years from now, when a lot of the assets have already matured and are gone, the roll-off will be frequently below the cap, esp. for MBS. So by then, the roll-off will slow down, unless the Fed changes the plan and for example starts selling MBS outright, which it is considering. I think this will drag out for longer as assets decline and the roll-off gets smaller.

Wolf,

I asked a question about the losses the Fed will be taking when they sell off debt assets in a higher interest rate environment than where they purchased them? Could the limit of $95 billion be a hard cap, since maybe that is an amount where they can afford to offset the loss on the sale versus the interest they are earning on their RRP program?

I would love any insight into this.

Isnt this potentially a really big issue?

I feel like the Fed is really trying to bring down inflation expectations with alot of really aggressive talk, but not really taking that much action because if they truly did rapidly increase interest rates, they would then be selling assets with a larger loss against the price they paid. At some point this becomes a real big problem.

There have been a few senators that have wanted to audit the Fed. I know this wont happen, but if it did, wouldnt it demonstrate that the Fed is essentially “illiquid” in the conventional sense of the words “higher debt than assets”.

It seems to me that if we had all financial institutions mark-to-market all assets every quarter, we would stop these BS financial games that are played.

“I asked a question about the losses the Fed will be taking”

See my reply to your comment further up.

The actual rolloff for MBS is already unlikely to reach or exceed the caps in the near future, no? So if two years from now they won’t be reaching them either, at what point *do* we expect them to actually meet the caps?

MBS don’t roll off until god knows when. They come off via pass-through principal payments, and they have slowed a lot. But there is still a pretty good flow. An increase in home sales as prices drop, and an increase in foreclosures would speed up pass-through principal payments. If three years from now, mortgage rates drop from, say, 8% to 6%, there will be a wave of refis, and pass-through principal payments will speed up a lot (this happened in late 2018 and early 2019 when mortgage rates came of 5%).

Pass-through principal payments from MBS are very unpredictable. And that’s one of the reasons why the Fed hates MBS and may end up selling them outright to get them off its balance sheet.

Does the Fed pay interest on the money the government deposits in the TGA?

No, just like my checking account.

If, as Ron Paul argues in his 2009 book *End The FED* – how is that possible without massive default?

The enormity of the problem, against our systemic corruption, leads me to think that it would take a minor trip and tumble to cripple the processes that support the financial system.

Wolf, I’ve read opinions that SOPR gives the Fed a freer hand in controlling U.S. monetary policy vs. LIBOR. That SOPR could be the Fed’s ace in the hole.

Can it really be much of an advantage when it comes to dealing with inflation?

I think you mean “SOFR” the Secured Overnight Financing Rate. SOFR is an average of short-term market rates. The Fed wedges these market rates into a range via its policy rates, including the FF rate, the repo rate, and the RRP rate. So yes it kinda controls those rates and any averages derived from them.

LIBOR wasn’t based on market rates. It was decided between banks behind closed doors. And the scandals about LIBOR manipulations by banks are legendary.

Excellent article Wolf, would it be possible to do a similar one for how high interest rates can be hiked?

There is no theoretical upper limit to interest rates. But there are some practical limits. In Argentina, the policy rate (“Leliq”) is nearly 70% (seventy percent). And it might go higher still. In the US, I’m currently seeing 4% FF rate by early next year, and if inflation doesn’t go down and stay down, it might go higher. I don’t envision 70% tho.

If we assume The Good Times is a good indicator of a healthy balance sheet (ironic, since I thought it was bloated), then the inflation-adjusted goal of QT would be a balance of $5.8T by the end of 2025. This assumes the Fed can trim 1.5% per year off the current inflation trajectory via QT:

Year Balance (trillions) Inflation (assumed in parenthesis)

2018 4.5 2.44%

2019 4.6 1.81%

2020 4.7 1.23%

2021 4.9 4.70%

2022 5.3 (7.%)

2023 5.6 (5.5%)

2024 5.6 (4%)

2025 5.8 (2.5%)

The usual caveats about the way inflation is measured vs. what things actually cost probably puts that number north of $6T.

I wonder if The Good Times is somehow the new normal for a hyper-financialized economy? This would be an economy where the calculations in this article are the lower bound, the upper bound is yet to be established via QT, and somewhere around $6T is the Goldilocks figure.

I can’t believe I’m even considering this concept as rational. I had always assumed we’d have to eventually find our way back to a balance sheet ratio to GDP that was more like it was before the financial crisis.

Wolf:

A quick post to thank you. I appreciate that:

1) You build knowledge methodically over time and multiple posts, challenging the reader without crushing them under complexity.

2) You ask only that the reader actually reads and set clear expectations for those that comment/ask questions, resulting in a comment section almost as educational as your main post.

3) You maintain (incredible!) patience/written composure when you engage readers in the comments section, despite their not fulfilling #2.

4) You are tenacious in your consistency, both in the regularity of your content but also the repetition of your themes.

5) You do not infuse your posts with partisanship and, where possible, attempt to disabuse commentators of their more toxic notions.

6) Finally, you “brook no bullsh*t.

Thank you very much for what you do and how you do it. I’m always learning a lot. I very much hope that the majority of your readers feel similarly and am always heartened to see the occasional comment section posts that offer their appreciation of your work.

Cheers,

A.

Your comment says everything I was gonna say, so I second that! Thanks “A”, and thanks Wolf. Your insight is very much appreciated.

Amarok,

Your mastery of the English languish is impressive.

Wolf’s artistry also are masterpieces of communication and the details are very easy to understand.

Thank you Wolf and I look forward to more comments from Amarok.

Awesome teaching. Thank you.

Great article Wolf! Unlike EU banks Canadian and American banks get a free lunch from the central bank. Thanks!

What happens when we go to a digital dollar?

For TPTB it would revolutionize the global tax evasion industry. For everybody else it would enable detailed surveillance of your finances.

Libertarians are conflicted.

I don’t see how they can move to 100% digital with 2.7 trillion worth of actual cash floating around the world. Seems the only way would be to hyperinflate the current dollar so those paper dollars are worthless, then reset to a digital dollar.

But the FED seems like that want to save the dollar at this point.

The Fed is struggling with this right now, if it ever happens. What the Fed already said is that a digital dollar will be a liability on its balance sheet, same as currency in circulation. It will be handled similarly. It will not replace currency in circulation, though currency in circulation might decline at that point. The digital dollar would provide for instant direct payments between parties and thereby replace a profitable part of the banking system (transactions), which is a real problem for the Fed, and that’s why it is dragging its feet.

At some point the Fed will face paying interest on their own printed funds to the commercial banking system.

The Fed buys treasuries with printed money at a low yield, this enters the general economy (unfairly but whichever) and thence to the US commercial banking system. In order to prevent this money from being spent the Fed needs to pay for it not to be spent, and that is interest on reserves.

Interest on reserves is higher than the interest on the purchased treasuries. So soon the Fed will be paying -additional- money to the commercial banks in order to stop spending and these losses will be covered by the government/congress. Not a good look politically.

This situation is already there for the Bank of England, who are insulated from losses as they are underwritten by government, so what used to be profits from printed cash now turn into a loss.

Equally for the ECB, who provided banks with long term cheap funding, now find they have to provide a higher rate of interest to stop banks disbursing the funds into general spending. Hence the ECB wants a windfall tax on the banks to stop what is direct taxpayer money going to the commercial banking system.

Btw I did read the article but more full of content than usual and i think a useful summary would be that the way the Fed operates is that it will pay you not to spend a dollar. Maybe its just 4 cents a year or whatever, it dampens spending by paying people not to spend. Now there is all this printed money in circulation without an accompanying debtor to pony up(gov got cheap fixed debt) all of the costs of paying people not to spend are going to fall on the Fed.

This is IMO. I might be wrong of course.

Let me just address the paragraph that starts with “Interest on reserves is higher than the interest on the purchased treasuries…

Check out the chart of reserves. They plunged by $1 trillion since the end of 2021. The interest rate on reserves is now LOWER than the 1-month treasury yield, as I pointed out.

So the question is why would banks hold assets at the Fed instead of buying Treasuries? And my answer (correct me if wrong) is that the banks dont want to hold Treasuries in an environment of higher interest rates because the value of the bonds falls as interest rates go higher. So the Fed is essentially taking that interest rate exposure risk away from the banks in exchange for a slightly lower interest payment.

Is this correct?

Do banks have to mark to market the value of Treasuries they hold? I think they changed the rules on mark-to-market on some other types of assets (mortgages) during the last crisis?

Your assumption compares reserves to Treasuries with long remaining maturities, because that’s where the losses occur. But if you buy a 1-month Treasury and hold it one month, you get interest and principal then there is no loss. Even if you sell after two weeks, the loss is so minuscule you might not notice it. So that should be the comparison, and that’s how banks look at it. The 1-month yield is now higher than the interest on reserves.

Reserves are more liquid than Treasuries. They have instant liquidity, and you don’t have to first sell them to get this liquidity. And that’s one reason to hold reserves.

BTW, banks hold LOTS of Treasuries.

Thanks Wolf, You really methodically guided me through the future QT part. . Thanks for the taking your precious time to simplify mundane issue for the simple mind to comprehend

That’s an interesting analysis of the theoretical limit for QT. I don’t want to see any MBS or long-term Treasury bonds on the Fed’s balance sheet when QT ends. In addition, I don’t want the Fed to use any more Enron-like “special purpose vehicles” to get around laws forbidding the Fed from holding long-term bonds.

Wonderful article Wolf. Your breakup of your Liabilities side estimates makes a lot of sense, Also it made me realize that overwhelming focus only on the Asset side of FEDs balance sheet is somewhat misplaced. One doubt

“In other words, as demand for paper dollars rises, banks must get more paper dollars from the Fed, and to get them, must post more collateral at the Fed. ”

Assuming reserves have not hit the theoretical minimum (1.6T), then, is it also possible for banks to convert some of the reserves they hold at FED to paper dollars, in such a way that one liability gets transformed to other without affecting the asset side.

It is teacher’s day here, so many thanks for your daily teachings :). Always grateful for them

Good question, and I should have addressed it in the article.

Reserves are bank cash, not collateral. Banks can “buy” stuff with reserves and they use it for transactions between banks, but they cannot post reserves as collateral.

Banks cannot “buy” Federal Reserve Notes (paper dollars) because these paper dollars are not for sale. Banks have to borrow them from the Fed and post collateral in exchange. The Fed accepts a variety of assets as collateral, but mostly Treasury securities, federal agency securities, and securities from government-sponsored enterprises, such as Fannie Mae.

‘Banks cannot “buy” Federal Reserve Notes (paper dollars) because these paper dollars are not for sale.’

They’re called Federal Reserve Notes to remind everybody whose property they are. The Fed is just letting people use them, presumably so they can get into trouble with inflation, overpriced homes, wasteful consumption, and debt.

so the Fed has to put trillions of dollars into “markets” to make the markets work which it didn’t need to do before approximately 2008 (not in that size anyway) What part of any of that says we have anything resembling a functioning market???????

As Warren and Charlie stated it’s a casino,and the house wins .

Lots of winning. Lots of Charlie Sheen. Even Andreessen-Horowitz house is still winning. They got Adam Neumann back from hiatus on their pitch deck, pitching a brand new scheme.

The house may win for many years. But such a house, when it’s a house of cards, can crumble very fast. People, analysts, were shocked by Enron. Shocked. How could it be? When Enron turned to vapor, it turned to vapor very very fast.

Thanks again for your continued information and excellent site.

Can you please point me towards some information that has the current planned time line for the scheduled QT (or Wolf educated guestimate) ?

I am interested in knowing when the QT is planned to approach, say, $2 trillion, $2.5 trillion and $3 trillion.

“So my calculus says that the Fed could do a maximum QT of about $3.8 trillion.”

The life of a Repo man is always intense.

No one is innocent.

– Agent Rogersz, Repo Man

It’s all part of the cosmic unconsciousness.

“…the trunk? Ohhh, you don’t want to look in there…”.

-j. frank parnell

Does the deflation in asset prices eventually lead to deflation

in the cost of living ? If not, life is about to get much harder.

Of course not ,the world has been oversupplied with energy,now it’s a political weapon .Energy is the dog ,everything else is the tail. Water is in very short supply . But we stupid humans keep building in desert environments.Can’t fix stupid

Theoretically, yes. However all politics are local… as are asset prices. If you happen to be sitting on real estate, and your house value shot up 40% in the last two years, but now is going to fall 20%, you probably won’t care because it is all paper gains and losses. But if you bought a house at the top of the market, you may have a few more grey hairs, and if you bought at the top of the market with some sort of variable financing… hold on because the future is going to look bleak. That is just one example, but you can imagine how taking the foam off the top of assets (whether they be real estate, mortgage-backed securities, stocks, etc) can have a cascading effect, as real-estate investors decide to dump their properties, people stop buying home improvement supplies, Home Depot lays off 20% of their staff, those people cancel plans to buy a new car, etc. So yeah, you might find a sheet of plywood drops in price 50%, or suddenly used cars start to become more affordable… but behind those price reductions there are going to be a lot of bruised consumers.

You can have asset price deflation and consumer price inflation at the same time, no problem.

And in fact we did in the1970s.

Absolutely – isn’t that we should expect after more than a decade of asset price inflation greatly exceeding CPI inflation? This seems like a good reason to hold cash even as CPI inflation stays high.

Yes, it should be expected.

Look at long-term charts of household net worth to GDP and debt to GDP. All debt is someone else’s “wealth”.

There is nowhere near enough actual production to use more than a minimal portion of this “wealth” in the real world. So, the only way it can avoid losing real value is by never going anywhere.

Asset values are also going to crash because of “risk off” loss aversion. This is reflected in rising interest rates.

No, for 39 years, asset prices increased with relatively modest price increases for most goods and services.

Now it’s time for living standards to decline noticeably due to unsustainable debt borrowed at artificially low rates.

Look for a long-term major bear market in all major asset classes, noticeably higher price inflation, and much tighter credit conditions at much higher interest rates.

The majority of Americans are destined to become poorer or a lot poorer.

So, the injection of play money worked in some ways, ultimately unsustainable, as is finally demonstrated by current inflation. A more “normal” relationship of money to other assets hopefully will follow (not to get complacent in any direction). Is the Fed finally, at last, struck sober?

It will serve me to re-think expected asset prices. Like a steroid hormone treatment regimen, it had to be withdrawn someday, and someday is now. Asset prices falling (vis a vis US dollars) is part of the rebalancing toward more rational pricing, I hope will happen. To many it will simply look like a loss. I wonder if this normalization will help generational inequality. Who knows?

I question who the resulting winners and losers will be (apart from the usual suspects winding up in the usual outcomes). My inclination now is first to be mentally limber, on how many dollars I will get as I sell down my assets (as an aging boomer). The point for me is not to be too anchored to the past, especially the recent past play-money era. I still need to be able to pivot and rebalance as it unfolds.

A normal relation I am looking forward to, is that as interest rates increase, P/E ratios decrease.

Trying to understand:

If ‘currency in circulation’ is rocketing upward as that chart shows, doesn’t that toss gasoline on the inflation bon fire? I noted the comment about folks tiring of holding dollars, but seems like any fix is a long way down the road unless $ in circulation can drop quick.

I hear so much about too many dollars chasing too few products/services is “inflation”.

CreditGB,

Most of the currency in circulation is stashed overseas, often related to illegal activities. According to Fed estimates, about 70% of the $100 bills are held overseas. So this is not a US inflation issue.

But if these paper dollars were suddenly arriving in the US by the container that then burst open and dump these paper dollars on the streets for people to grab and spend, it would drive up inflation. I doubt that will happen, and if it does, let me know where those containers with cash show up and burst open :-]

I will let you know where the 2nd container of cash is shortly after I’ve unloaded the first one. 🙂

Thank you for the clarification.

Better bring a bank teller with you when you rush to the open shipping container from overseas, Wolf. The U.S. $100 bill is the favorite currency denomination to counterfeit around the globe. When I get cash from the bank to pay my subcontractors, I try to avoid $100’s each and every time. Currency is indeed a depreciating asset for Americans, but still a reasonable liquidity vehicle.

I must say, I really have no understanding at all that big money, CB stuff. Reserves, assets, liabilities of the CB are just meaningless abstractions to me.

But one concrete question comes up for me: in your last paragraph you say:

“If inflation continues to rage, paper dollar holders may get tired of getting mauled, and they might convert those paper dollars into interest-paying assets. ”

Please tell me– what are these “interest paying assets?” of which you speak. I would love to know. Stocks? Bonds? CD’s? Hmmm.

My intuition is that since at least 2008 central banks have discovered that the cure to any asset that gets shaky is just print more money and purchase the crashing asset to get such trouble out of the way. I.e, asset insurance for the rich.

My instinct is that as “financial assets” for the rich rise to higher and more insane values they are becoming nothing more than cost free, and value free abstractions of numbers, and that trust will eventually disappear for all of them–when no one takes any of them seriously anymore, and none can be used for exchange to obtain any actual value of actual, real products/services. High inflation, with money, stocks, bonds and money all becoming meaningless near infinite numbers of bits in a computer somewhere.

“what are these “interest paying assets?” of which you speak. I would love to know. Stocks? Bonds? CD’s? Hmmm.”

Short-term Treasuries (bills) yield between 2.5% and 3.5%. High yield savings accounts are at 2%. Brokered FDIC-insured CDs are over 3%. High-grade (AA) corporate bonds are at around 4.3%. So there is yield out there.

It doesn’t cover inflation. But that’s not your choice. Your choice is between earning 0% on paper dollars or 3.5% on Treasury bills and x% on other stuff, while inflation is the same for all. So you’re a lot “less worse off” earning 3.5% than earning 0%.

Yes Wolf, as you say Treasuries “don’t cover inflation.” And maybe AA Corporates. If that’s all I’ve got, not a great choice. Good options to lose the least possible wealth!

“Good options to lose the least possible wealth!”

Yes, “less worse” is the phrase I used. As opposed to “worse” or “worst.”

This is a shitty investment environment. I-bonds roughly cover inflation, but you cannot move a whole bunch of money into them all of a sudden; this is something you do every year, at the max level. Most inflation hedges (stocks, RE, cryptos, etc.) either have already failed spectacularly – saddling you with a big capital loss in addition to the loss of purchasing power due to inflation – or have started to fail. Even gold hasn’t performed as an inflation hedge this time around.

“Even gold hasn’t performed as an inflation hedge this time around.”

That may be true for people in the USA, but it isn’t true for people in other countries.

Gold, despite recently falling in price, has still had one of the better performances over the recent past compared to other asset classes.

For example, in yen terms gold is up by 4% over the past six months and 20% over the past year.

And as far as all those US dollars floating around the world outside the USA, they provide a type of free interest rate loan to the Fed and a liability that will probably never have to paid.

Verizon and ATT now pay dividends above 6%. But they have declined 20% in the last few months. So if you’d bought in July for the then 5% dividend, and need to sell to raise cash for some reason, you’d be a loser. Someday they might recover. As the market in general still has a long way to drop, probably too soon to buy just yet.

People not paying their cell phone bills?

Both companies have garbage balance sheets. Their interest coverage ratio is high because of long-term interest rate suppression but it will grind lower over time organically now that the 39-YR bond bull market is over.

It will also collapse when their earnings crash in the next economic contraction after which the dividend will be cut big.

“It doesn’t cover inflation.” Even less so after taxes since that’s ordinary income. You’d think .gov would at least waive income tax on interest income below CPI since real interest rates are largely determined by the Fed. Yeah, right. We know that we won’t see a return to inflation indexing any time soon on cap gains either.

Wolf,

I appreciate the amount of work that goes into producing these kinds of posts – tracing the (very) convoluted techniques the Fed uses to operationalize its control/manipulation of the financial overlay of the US real economy is very difficult.

(Nobody on the inside really cares to make these operations particularly clear, because it doesn’t serve their interest for there to be a general awareness of just how thoroughly DC can control individual financial standing – they basically want to run a fairly centrally managed economy – via finance – without openly acknowledging they are doing so).

But, at the end of the day, that is *all* the Fed is doing – controlling/manipulating the *financial* *overlay* (well or awfully, as the case may be).

But the true, base, fundamental economic equation – the one that determines the long term fate of national economies – the productive efficiency linking true international cost of inputs to true intl value of outputs, really only gets diddled at the margins by all the Fed’s *financial* manipulation (it is an *overlay*, the essentially symbolic representation of more fundamental real economic relationships).

The simplest way to think of this is to realize that in an instant the Fed could (theoretically) alter the “money” supply from $1 to $100 bazillion (or the reverse).

But…doing so (while truly f’ing up the financial mkts) would 1) leave the immediate real asset endowment of the nation unaltered (although affecting productive incentives *at the margin*) and 2) also leaving the real productive efficiency of the nation (true input cost vs true output value) unaltered.

This is as it must be – central banks are just shuffling and redenominating *paper* – not altering real economic relationships, except to the extent their expropriations (read inflation) or political gifts/graft (read DC spending) alter individual economic incentives over time (quite frequently for the worse, as economic actors gradually realize they are marionettes under madmen).

While everybody appreciates how much effort you put into hacking into the head high weeds of Fed operations, the effort it requires makes it really easy to miss the swamp for the weeds.

Everything you recite above *will* have differential impact on different segments of the financial/capital mkts (that is the Fed’s *goal* after all) but besides always keeping the *real* economy distinction in mind, a ton of *additional* work is required to track (and more importantly, clearly explain) those differential capital mkt effects.

I don’t think you really do that here (understandably) and it makes it harder to follow 1) your explanation of Fed operations and 2) their capital mkts significance (which is what I guess 90% of your readers care about).

There is another major point – since the Fed is implicitly endowed by DC to act with a basically shocking degree of caprice in regard to the US money supply (ie every dollar holder’s accumulated wealth) they more or less have infinite tools to that end.

Although you lay out a detailed argument for a “floor” for QT, I think the Fed is implicitly empowered to simply use some/any other tool to transcend that floor (using current madness to offset earlier madness…).

For instance, the Fed could simply jack banks’ reserve requirement to “tighten” beyond the floor you describe.

(The Chinese have manipulated *their* reserve rqmts to profound effect for 20 yrs).

When it comes to tools of monetary manipulation, central banks have a million of ’em.

That is why it is so important to mainly keep your eye on the true, underlying real economic relationships.

(And transnational exchange relationships, since the various CBs don’t manipulate in unison…each pursuing its own ntl interest mainly. Watching trade balances over yrs will tell you more about the underlying health of a nation’s economy than a hundred CB rabbit holes).

Bravo! Best comment IMO. Great job covering many points I was thinking

And may we suppose that the definition of a liquidity trap occurs while RRPO is still open, [the Fed stopped buying QE bonds but reserves keep climbing, or the need to convert those reserves to collateral] and banks need RPO, cash (dollars – a dollar shortage) and they are willing to swap treasury paper. Fed’s role in all this [used to be] a third party meant to smooth over the gaps in market supply, cash or treasuries. The Fed could drop interest rates and MM rates would follow, and demand, or wait for the transition, moment when the need for dollars exceeds the need for collateral, to lower rates for them, [banks begin loading up on short term treasury paper in order to borrow cash – by selling what exactly? or borrowing what exactly??] Several years ago a CITI analyst said if Fed policy continues one day soon investors will be borrowing money to put it in savings. That sounds vaguely deflationary but with the dollar rising out of context, in relation to debt and spending, maybe not far fetched.

I don’t believe people with turn in their mattress dollars to earn interest. If anything, the mattress dollars will increase as things become more scarce, and life becomes scarier. People know in a pinch that ATM’s will be the first thing to shut down.

There’s no reason to believe that ‘things will become more scarce’. Supply chains are healing, store shelves have fewer bare spots. Not perfect but improving.

The less trustworthy you make your currency (by manipulating its supply), the less economic actors/investors want to be exposed to your currency (borrowing/lending in it, accepting it as pmt for real economic goods, etc).

This can cause horrific macroeconomic disruptions.

So don’t discount DC’s ability to turn macroeconomic mismanagement into an “impossible/unthinkable/inconceivable” outcome.

(For example, the lavishly funded US military (DC run) only bats about 50% in wars against non-industrialized nations that possess 1/1000th of the material resources of the US mil)

(Also, see Pandemic, CDC and)

Remember during the pandemic when the “mighty” US economy (“Richest Country on Earth” TM) not only could not produce anywhere near sufficient face masks (in many ways a pathetically simple real good) but it *never* came close to doing so (so much for WW 2-style industrial miracles. And I think industrial powerhouse GM is *still* working out the bugs on “Freedom Respirator” #1…).

Now imagine a day in the not distant future when the hundreds of thousands of exporters around the world simultaneously wake up and realize,

“Hey, these perpetual deadbeat Americans have only ever paid me in this green tinted toilet paper, which they run off at will at the Fed Kinko’s. By the time I can turn around and try to buy some worthwhile US asset (er…) the value of my export proceeds have been debased. So…no more imported soup for you, my American deadbeat friends.”

Apply that dynamic to the tens of thousands of US imported products the US survives upon. Realize that the US has essentially been surviving on foreign credit for fifty years already – that’s what it really means when you run perpetual trade deficits…foreigners are taking US paper IOU’s (cash or cash recycled into US Treasuries) in exchange for their *real* goods (that require *real* resources to make, not just some political promise from an increasingly untrustworthy foreign gvt).

If you screw up the currency you are almost by definition going to screw up all the supply chains (as existing economic relations between suppliers/users get terminally warped by price volatility).

Don’t include exchanging USD for US real estate?

Anyone seriously wondering why many desirable locations in USA have had HUGE increases in land purchased by folks who are not USA citizens?

Anyone seriously wondering why many folks are willing to travel from all over the world to be able to pay large money to walk across the borders and disappear into USA?

Anyone seriously wondering why many people are willing to trade their local currencies for USD almost everywhere on earth?

ETC., eh

Vintage,

Actually I do think a lot of foreign exporters recycle/divert USD proceeds back into US real estate (mainly residential…it is an escape pod for Chinese firm owners fearing the CCP and not wanting their savings held 100% hostage in compelled Yuan holdings).

And I do think this dynamic is behind a lot of the absurd RE distortions we’ve seen over 20 yrs (soaring home prices despite stagnant US salaries over most of that period). Add in ZIRP and you have a recipe for the toxic stew we’ve seen.

But I also think it is a trap for those Chinese.

As the US political system disintegrates, it has become a fountain of rotating diversionary villainies (“Everyone/anybody but our policies are behind America’s economic decline”).

Sooner or later DC’s Sauron gaze will fall upon foreign owners of US real estate (after turning a blind Eye for decades) and they’ll become the Evil Incarnate du Jour. Huge taxes will be levied – one way or another – on the latest Others…after all the insatiable Maw must be fed.

All the foreigners holding dollars know that size matters no matter what she says. The US dollar dwarfs it’s nearest competitor in world trade, and when lots of richer people than you want the same thing that you do you’ll ride along gratis. They’re your best insurance. Everybody knows that the dollar has it’s issues, so does Microsoft, Boeing, and Walmart, none of them are going anywhere. Because they’re big, and at a point of critical mass they offer safety in sheer size. The US dollar buys their software and airliners and ramen noodles. Lots of energy too. People really don’t want an honest money without arbitrage and leverage and usurious possibilities now anymore than they just want their house to be a domicile and not a daily reminder of their financial acumen. Nobody wants a gold backed anything, no matter what they say. That kind of money tends to cost too much for most. The dollar is doing okay, given it’s many detractors, and is nowhere near it’s oft-predicted demise. Offshore cash is a huge inertial stabilizer, for now at least. $100 bills used to trade for $105-$110 in ones in Eastern Europe. If there’s that many discounted singles floating around, it postulates an immobile cash float that can’t come home quickly, good.

There’s a few foreign currencies that tie their value to the US dollar too.

Oligarchs and unbanked gangsters/warlords prefer dollars as well, the logistics of bribery in inflationary times become more challenging when they’re bought with the cheesy local currency. Everybody needs a buck or two.

“There’s no reason to believe that ‘things will become more scarce’.”

That’s because the planet’s resources are infinite and there’s no way eight billion or even twenty billion people could possibly use it all up, certainly not with the prospect of exploiting those rich lands on the Moon, Mars, and Venus for cheap.

Until the winter rolls around and the midterm elections are over.

Time and Level. This rate hike cycle should peak in the spring of 2024……coincidentally just in time for the runup to the Nov. 5, 2024, selection and subsequent Jan. 20, 2025, coronation. The actual peak rate achieved is not readily predictable from the charts, except that it will eventually exceed the inflation rate. According to the Taylor rule, the FFR thermostat right now should be 9%.

Yes I too appreciate your articles and I send you a monthly contribution so show my appreciation. I am sorry the contribution does not come close to value of your articles but I am retired and it is the best I can do right now.

I am still trying to discern the forest from the trees when reading your articles. Is there a flow chart available somewhere that shows how money flows regarding the fed, central bank, banks and the government?

What an excellent article! I have an objectively better understanding of the Fed and its balance sheet than I did a half hour ago.

That being said, man, interest on reserves is a bad idea. As the Cato Institute put it over 10 years ago, it’s not just deflationary but violently deflationary. The ‘big deposit’ regime is terrible. The Fed is not all-powerful; it has to serve so many masters and juggle so many priorities it never had a chance of making any of them really happy.

QE was the “bad idea” — the original sin. Interest on reserves is just an outgrowth to keep the QE side-effects from spiraling totally out of control.

What can “regular people” like myself do to effect change so that QE is relegated to the dustbin of history? QE is essentially a rich man’s trick to f**k everybody else out of their money and standard of living.

I think QE was supposed to steal from the old people or savers to give to the young people but in the end the young people ended up even worse off that the old people they originally stole from.

Very interesting and I very much appreciate the break down, but was wondering if someone could provide a bit more color on $800B in TGA.

I pulled it up on FRED and while I understand the idea of government entities temporarily parking money at the Fed, I’m curious why they started parking significantly more during/after the housing recession and then began to grow those amounts more or less linearly beginning around 2014.

My expectation would be that the government spends almost all of the funds every year or they are forfeit.

Andrew Wangelin,

I explained all that in the article. You have a misconception about the TGA that you need to shed. So go ahead and read the article. I swear, it doesn’t bite.

Wonderful article Wolf. Bookmarked for many future reviews.

Concurrent QT and interest rate hikes in a negative GDP environment is insane.

Bnguyen,

No. But policy interest rates are way too low in the face of this inflation, and QE should have never happened, and if it happened should have been unwound long ago. So you can kiss the Everything Bubble goodbye. I hope you enjoyed it while it lasted. It was truly spectacular.

QE and interest rate repression inflated the Everything Bubble. QT and rate hikes have been deflating it. There is now a whole generation of speculators out there who have never seen an environment where markets have to exist without the Fed whipping them higher relentlessly.

What bubble ? Marc Andreessen would like to have a word with you at the party this evening Wolf about bubbles. It’s a fine party too- Adam and Rebekah are out there on the pitch deck. Nothing but good times and helping the little folks. Thanks for another solid writeup.

The Fed is trying to use its tightening tools to create a recession-ish state to help it fix the out-of-control inflation. However, this creation is like a big blackhole that can either help to slow down the inflationary inertia of the economy ship or suck the whole ship in, which is more the likely scenario.

TIL that cash in circulation is physical cash in circulation.

Hoarding dyring COVID.

But savings rates are going up, so cash in circulation will go down as it will be in the banking system, right?

What does that mean for the stonks, cryptos, social media NFTs and $10,000 a visit meet and greets with your local TikTok influencer?

I read the article!

Barely. Thank God we got wolf to think this stuff for us. I’m going to take wolf’s word on it that the fed has a floor for how much it can run off during QT.

Question: when you say that a max runoff during QT will lead to asset price declines, is this based on logic, gut feeling, historical precedent, or a direct relationship? The reason I ask is because there were a ton of well reasoned predictions about QE the last few times so I am skeptical we have great handle on QT either and the magnitude is unprecedented. It seems like qe at least was a bit slower than rate changes or fiscal stimulus in impacting economy.

When I read this and try to fully understand it, I start to get a more clear picture.

The Federal Reserve has basically taken the risk of interest rates away from the banking system and put it on the Federal Reserve by guaranteeing interest rates they pay, while they take the interest rate risk of Treasuries on their balance sheet. Because the value of a Treasury falls when the interest rates go up.

Fannie and Freddie have taken the risk on mortgage defaults.

So our government has taken all the risk of the financial markets, and left the financial market players with only the returns.

Love this socialist capitalist system.

Mr. Wolf, thanks for the article.

A noob question, my understanding is that money market funds take part in RRP but they do not lend to the real economy or invest in stocks / housing. As Fed does QT, the cash from the money market funds will move from RRP to treasury bills. How will that help reduce inflation or reduce asset prices? thanks!

Wolf, Y2K *would* have been a big issue.

A couple of million programmers spent 5 or 6 years intentionally making sure that it wasn’t.

I was a developer at the time, and I fixed a few that would have caused big problems.

Me too !

Wolf:

What are you trying to do: single handedly bring down the cost of college by offering 3rd year economy course work at a fraction of the cost? If so – and I am all for this – have you factored these massive college ‘savings’ into your models? I expect it would drop the currency in circulation (for coffee, if nothing else) substantially and thus the Fed’s floor noticeably. But, then again, since it arrives in real time, I don’t know because I’ve not taken the 2nd half of your course yet.

I like this new ‘Wolf U’ approach: the Sunday Wolf Street Report large lecture hall, the Tuesday run the numbers labs and the Thursday break out ‘what does it all mean for my weekend?’ behavioral economics feedback queries. This is a much better course than many of the Econ courses I took in the early ’70s (with WAY better grad student course question follow ups in the comments). I shutter to consider the social disruption if your offerings get accredited. I mean, there’s only so many talking heads the internet can absorb (although we are testing this idea) from the ranks of unemployed Econ professors you will produce from your disturbance of the force. Then again, you might just produce a general ‘economic awareness’ to challenge the often nonsense of these talking heads thus producing a demand stabilization conceivably bringing down reserves needs, and perhaps taking your Fed floor down even further.

But please, no pop quiz just yet as, these days, I am usually a couple of days behind the brighter students in the comments section – which has grown large, louder and informed – finding this time is necessary to fully absorb the many viewpoints produced from the lecture. Is pass/fail an option? Is pass/fail the only option?

Excellent explanation. One interesting result of QT is that the short term TIPS market has flipped from negative yields where it resided for several years, to positive yields. For example, according to the Wall Street Journal 9/2/2022 prices, the Jan 15, 2023 TIP has a yield of 3.873%. Of course, the September inflation adjustment will be 0, but that still leaves October through December adjustments. I have no idea why this has happened, some market anomaly, I suppose.

Your article has forced rusted gears and un-oiled drive shafts to engage, in my memory, about the basic accounting 101 equation of T accounts:

Assets = Liabilities + Owners Equity

Bank reserves: $3.25 trillion

US paper dollars (“Currency in circulation”): $2.28 trillion.

Reverse repurchase agreements (RRPs), total: $2.53 trillion

US Government’s checking account at the Fed: $670 billion.

I’m trying to decide which one is the most speculative. Promoting speculation has obviously been the main function of the Federal Reserve Bank of the United States for the last X times decades, at least 3.

I’m not saying that speculative funding doesn’t have it’s place, as any reasonable citizen would recognize the benefits of productivity improvements to the everyday man and woman, like me.

I think that the Financial Industry has been promoted at the expense of the everyday man and woman, like me.

Speculation has been established by the Federal Reserve policies for the last 20 years, establishing Finance as the principal industry of the US, comprising > 65% of GDP. I think that the Fed needs to stop with the policies it has established since RR, that transfers and concentrates wealth to a dis-functional aristocracy.

Your description of finance as an industry is a major exaggeration.

It’s bloated and unproductive, but nowhere near that much.

Since being born, I recognized the basic greatness what my, flawed, old man did one day during the WW2. Whatever he did, being shot in the face, he earned a purple heart, and was awarded a silver and bronze star.

He lived and had a large family which he fed by living in a society which the GI’s established that provided family level wages and benefits for white people.

Your email address will not be published.

Interesting stuff happening in the labor market, suddenly.

It sticks to plan, QT like clockwork: What the Fed did in details & charts, and my super-geek extra-fun dive into the “To Be Announced” market for MBS.

Huge losses, but now revenue growth is slowing. Hilariously, executives refer to the huge losses as “profitability.”

“Temporary” inflation is suddenly runaway inflation. But the negative-interest rate idiocy and QE are finally over.

The Case-Shiller index, which lags 4-6 months, is starting to pick up the price drops in Seattle, San Francisco, San Diego, Los Angeles, Denver, and Portland.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy