Block Island Wind Farm

John Moore/Getty Images News

Block Island Wind Farm

John Moore/Getty Images News

With the Inflation Reduction Act signed and Ukraine still under attack, now is the time to buy Ørsted, (OTCPK:DOGEF, OTCPK:DNNGY) the global leader in offshore wind farm development. My bullish investment thesis focuses on the company’s strong growth record combined with tailwinds in the global political economy. High oil and gas prices, caused by low interest rates and Russian sanctions, make renewable energy competitive on a price basis immediately while The Inflation Reduction Act further stands to bolster the U.S. secular transition to renewable energy. I make the case that Ørsted is growing at a reasonable price and argue that equity is a source of a pure and timely investment in a jittery market.

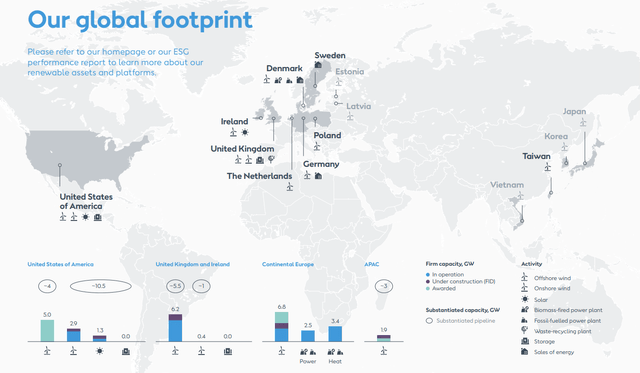

Ørsted has historically had many revenue levers in its operations, yet it has recently established concentration and experience in renewable energy development. It was formerly called DONG Energy, with DONG taken from Dansk Olie og Naturgas. The majority of the entity is owned by the Kingdom of Denmark, who as shareholders approved oil and gas divestitures that were completed in 2017 to concentrate on its renewable energy segments, which include onshore wind, solar, bioenergy, and energy storage in addition to offshore wind. As the 2021 Annual Report shows, offshore wind generates close to 400% and 1100% of the revenue of bioenergy/other and onshore segments respectively. While there are many exciting products and services supplied by Ørsted, offshore wind generates most of the cash from operations available to the business. Management even claims the status of “undisputed leader” in their recent annual report.

Ørsted Operations by Geography and Segment (orsted.com)

Ørsted Operations by Geography and Segment (orsted.com)

As an undisputed leader in this segment, Ørsted integrates a complex upstream supply chain as developer, owner, and trader of electricity. The full logistical and real economic scope of building an offshore wind farm is highly complex. Lots of fine machinery, vessels, and well-trained laborers are employed to complete the installations. As shown by undisputed leadership, Ørsted has engaged partners in successful project implementations time and time again. Mckinsey & Company Research shows how far ahead the company is when compared to Iberdrola (OTCPK:IBDRY), Equinor (EQNR), and RWE (OTCPK:RWEOY) in terms of both project pipeline and existing capacity. However, the difficulty of developing an offshore wind farm – from the site selection, to design, to manufacturing and installing the turbines, and the underwater cables that return energy back to shore – means that there is plenty of profit for industry players that are incorporated in the United States. In my opinion, any competitive concerns should be discounted by hypergrowth.

This growth is caused by tremendous value engineering. For example, Ørsted completed America’s first offshore wind farm, Block Island Wind Farm, which became operational in 2016 with a 30-megawatt capacity. This means that, theoretically, at the inked wholesale electricity rate of $0.244/kWh, the farm may yield up to $175,680 per day. For reference, the total cost of the project was $290M, about 1650 days or 4.5 years of output at full capacity by my calculations. Given technological progress and the tax credit financing programs, I only expect increased output and lower costs moving forward.

The passage of The Inflation Reduction Act comes in the context of what Bill Gates has popularized as the “green premium” in his recent publications on issues of climate change and energy. This simply means that renewable energy products and services are more expensive than traditional substitutes. In order to remain profitable, businesses must charge higher prices for products with both comparable specifications and lower carbon emissions.

This problem is manifested in the purchase rate agreements that wind developers have negotiated to premiums. Increasing prices beyond what legacy grid suppliers charge sets up ordinary citizens for increased utility bills. The Act offers up to a 30% tax credit on commercial and residential energy capital improvements from rooftop solar farms to improved insulation and storage. Offshore wind farm developments that begin before 2026 are included in this credit. This means that the developer will be rebated 30% of the project cost through federal tax credits that essentially pardon businesses from paying income taxes. Given that the government has committed to financing such a large portion, perhaps more than 100%, of the green premium, I anticipate that developers will have lost the negotiating power they once held over public representatives in effectively forcing the grid to pay premium rates. Wholesale negotiations and consumer price issues have plagued clean energy, and I am optimistic that the new legislation will much improve negotiations at the state and local tier of government. If it doesn’t improve these frictions, Ørsted knows the drill.

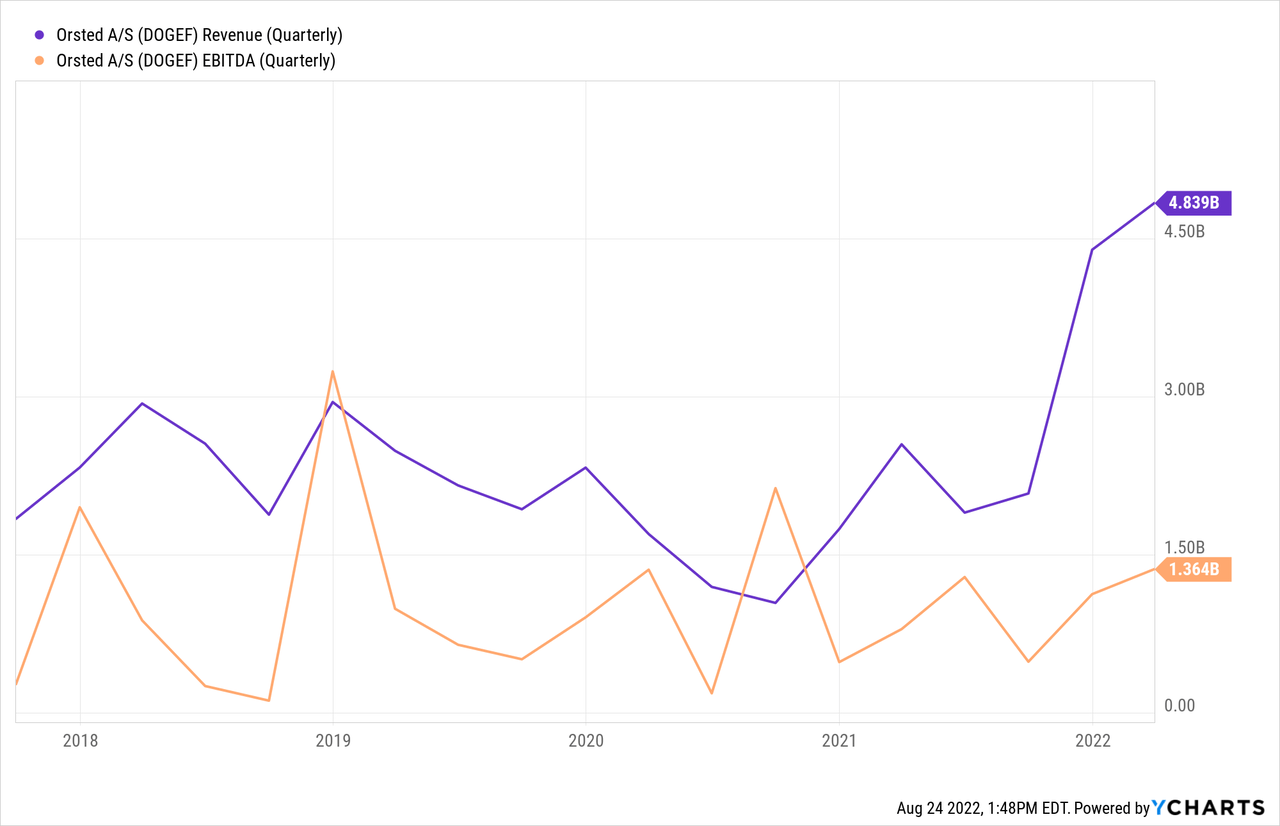

Financial performance is complicated by the Danish Krone unit of account. Fortunately, Seeking Alpha has furnished all three statements converted to dollars. TTM revenue amounts to $14.86B. December 2011 annual revenues were around $11.64B, implying an eleven-year CAGR of 11.6%. These numbers accommodate three consecutive years of declining revenue from 2013 to 2016. EBITDA CAGR is 8.4%.

Over the same eleven years, average annual cash flow from investing is about -$1.73B and cash flow from financing averages out to -$34.75M. The company has paid down debt over the past decade while retaining earnings, returning capital to shareholders, and investing in business expansion. Despite net cash outflows from investing and debt repayments, a net change in cash of around $780M speaks to the company’s demonstrated history of generating more than sufficient cash from profitable project development operations.

More recent financial activity shows the company’s efforts to gear up and finance more expenditures, as an excess of $1.2B has been raised through financing over the past two years. The sales pipeline looks excellent, with six more offshore wind farms awarded in the U.S. and two in construction before The Inflation Reduction Act became law. Now that costs are much lower, I am expecting a slew of new project announcements within six months.

Seeking Alpha Quant does not give DNNGY good ratings, and it does not register ratings for DOGEF. Comparisons are made against the utilities sector. P/E is a bit more than a 100% premium to the sector average, but price-to-earnings growth ratio is grade A+ at less than one, while other utilities companies average a comparable ratio of greater than three. The enterprise value to sales ratio is meaningfully smaller than the industry average, suggesting that Ørsted is actually undervalued when honing in on its demand and its full capital structure.

The poor earnings revisions score reflects only one recent downgrade, and momentum as defined by Seeking Alpha is essentially irrelevant to me given my horizon. The fundamentals and political vectors are the momentum I appreciate in this investment.

Unfortunately, a full valuation model such as a discounted summation of cash flows is beyond the scope of this article for several reasons, and a valuation estimated by comparisons is rendered difficult by the innovative nature of the industry. My valuation analysis thus focuses on challenging the book value, while combining components of cash flow and comparison techniques.

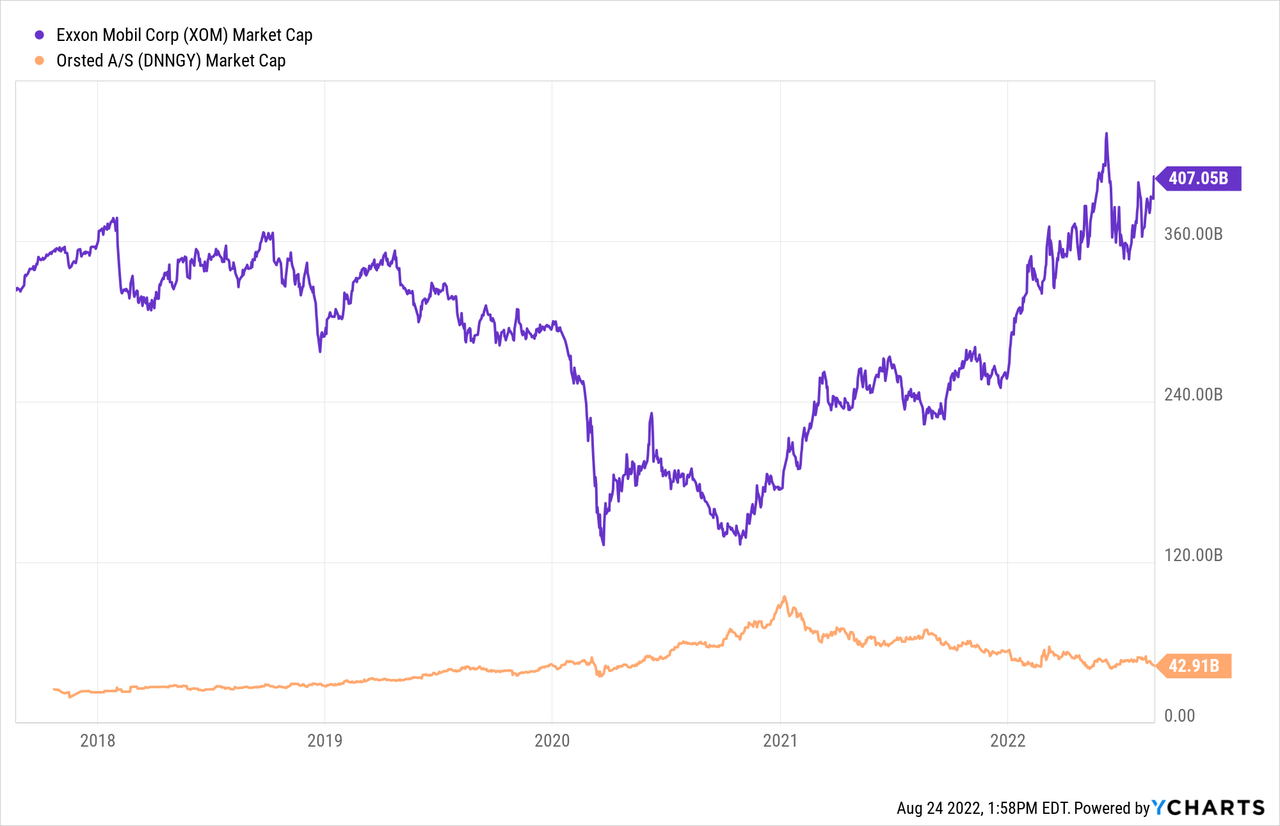

Exxon Mobil (XOM) is a company whose American industrial dependency I believe Ørsted may achieve once North American offshore wind is developed. I do not think it is outside the realm of possibility that the market capitalization breaks into “megacap” territory of $200B+ within the next two decades.

The book value of Ørsted is strong and likely understated. Seeking Alpha Quant doesn’t register book value ratios at the time of writing, which is another doubt that I have with the valuation assertions in these tickers. Total assets amount to more than $45B, so at the current market capitalization, Elon Musk could theoretically buy out the company and pay off its debts at about a 14% premium over the assets, as defined by a EV/Total Assets ratio, and I think that would be a far more synergistic deal than buying out Twitter (TWTR).

The intangible assets, such as the know-how to implement a project successfully, probably fall through the cracks on the balance sheet. Goodwill numbers for addressing such important climate change issues are laughably modest at just $20M. Other intangibles amount to $200M. Inflating those numbers to where they belong will help lower a price to book value that is otherwise around five.

When thinking about cash flow specifically, I am bullish that the new legislation, combined with the intellectual property held by Ørsted, will significantly accelerate Ørsted’s asset accumulation – that is, its speed in reinvesting cash from operations back into those same assets that generated the cash in the first place. Tax credits will not come immediately and thus are subject to a time value discount, but even if net margins in North America improve by 10%, that is still an excellent gain in profitability that would drastically change the output of a discounted cash flow valuation model.

Taking the power negotiation agreement rate for Block Island Wind Farm, as well as Mckinsey’s gigawatt installation projections prior to the new legislation, I estimate a conservative total top line of $40,800,000,000 on offshore wind alone. At a price-to-sales ratio of 2.4, the industry comparison, I conservatively measure more than 100% upside in share prices over the next seven years. That is about a 13.1% annual return with at least another point of return located in the dividend.

Please note also that the Danish Krone is pegged to Euro, which has depreciated remarkably in the wake of Federal Reserve’s hawkish guidance. I think there is a good chance that the ECB tapers more slowly than the Federal Reserve in an effort to capture latent American demand, and this further sets up a European leader for good earnings.

For many wise investors, the OTC market is off limits and for good reason. The two tickers that trade in the Americas are DOGEF and DNNGY. Both are pink-sheeted, OTC securities with claims on the Ørsted common stock that trades on NASDAQ Copenhagen and the London Stock Exchange. The American Depository Receipts are what many clean energy ETFs such as Global X Wind Energy ETF (WNDY) and iShares S&P Global Clean Energy Index ETF (ICLN) buy on behalf of investors. As shown in F-6 SEC documentation, a share of DNNGY may claim one-third of an ordinary Ørsted share, while a share of DOGEF represents a whole.

Political risk at the state and local level, where the oil and gas lobby may succeed, is legitimate; however, much of the coastline, like California, is quite blue, so I am not concerned on this front. Another risk is that the fisheries may be affected by the currents in the cables and that stakeholders will find that unacceptable, but Ørsted is managing this issue in several ways.

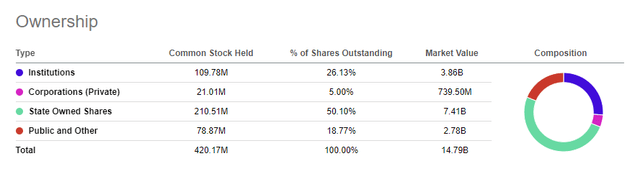

The last major risk to share prices which I have not yet addressed is majority Danish government ownership in Ørsted. Of an economy worth about $397B in 2021 GDP according to World Bank, at a market cap of $45B, Ørsted and its affiliate corporations are a backbone in the domestic Danish economy and essential to the programs linked with some of the best happiness metrics. The Danish fiscal conservatism is reflected by many years of nearly balanced budgets and about half the U.S. Debt/GDP percentage. Ours is in the sixties, compared to theirs in the thirties. Divestiture and economic diversification, like Saudi Arabia’s Aramco has explicitly prioritized, rather than any solvency issues, would be causes for an unfavorable share supply imbalance, but I doubt they would dilute or divest into a period of such clear growth. I’m cautiously optimistic that the Kingdom of Denmark will act with integrity as its assets service a global political economy facing secular and cyclical energy problems.

Seeking Alpha

Seeking Alpha

I began accumulating American Depository Receipts and currently have about 5% portfolio exposure. I do not intend to go beyond 12% and aim to have a full position before 2023. If you are able, the best way to invest would be through a broker network connected to the London Stock Exchange or Nasdaq Copenhagen. My intuition is that these shares are quite closely held by major stakeholders abroad, and there are probably many reasons for not allowing greater American liquidity. Pink sheets may be risky, but when this equity is regarded properly, the notorious “tail-end” OTC stock returns clearly bias the right tail. The upside is secular, cyclical, and noble.

As one Nobel Prize recipient wrote many years ago:

“The answer, my friend, is blowin’ in the wind

The answer is blowin’ in the wind”

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DOGEF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.