A few days ago, I ran across a new video from Grant Cardone on whether you should invest in REITs or Private Real Estate funds. Grant is himself a sponsor of many Private Real Estate Funds and so, not surprisingly, the video quickly took the allure of an advertising stunt seeking to sell his own private funds to watchers rather than providing an objective comparison.

I take offense with the video because it is very self-interested and highly misleading to all watchers. Grant bashes REIT vehicles by portraying them as paper assets that are not backed by real property that are unlikely to produce the returns that he is able to target.

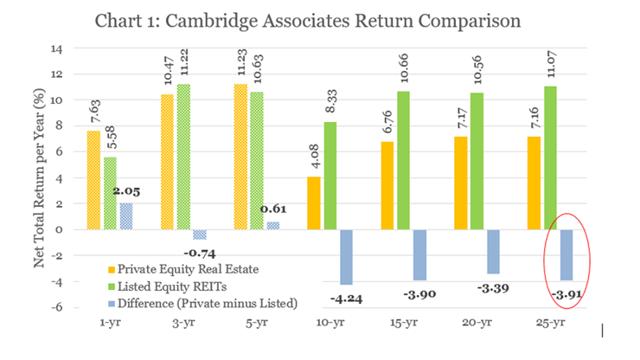

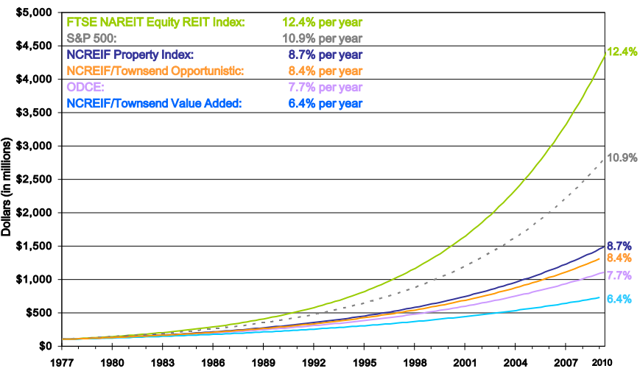

What he conveniently fails to mention is that REITs have historically produced significantly higher returns than private equity funds like his (on average): source

source

From 1992 until 2017, REITs returned more than 11% per year. In comparison, private equity real estate investments returned just 7% on average, or a ~4% annual underperformance. In other words, if you had a million dollars 25 years ago and invested it in REITs rather than in private equity real estate, you would have nearly two and half times more today.

This result directly implies that private real estate funds have significant flaws in their structure as compared to REITs as they tend to underperform despite often using more leverage, applying riskier strategies and being illiquid.

We identify 3 simple reasons why private real estate funds are (structurally) expected to underperform REITs on average:

REITs and private funds are managed very differently. Private vehicles are typically managed by an external management team according to a management agreement in exchange of a management fee and other diverse fees. REITs, on the other hand, are most of the time managed internally by a management team that is hired as employees of the corporation.

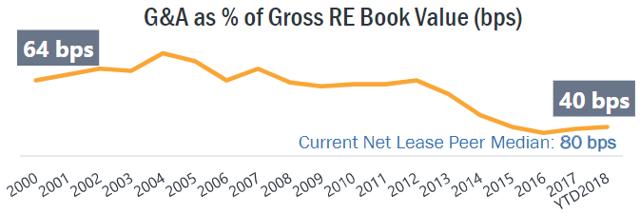

This difference in management structure is very important and can lead to substantial cost differences with the average private fund charging up to ~150-300 basis point in fees per year; whereas REITs are much more efficiently managed with just 50-100 basis point in overhead cost:

Source: EPRA

REITs enjoy significant economies of scale because their managers receive salaries rather than a fee that automatically goes up based on assets under management. The large scale is then a big advantage as all costs (overhead, property management, brokerage, interest, ect…) can be shared over a larger pool of assets.

Realty Income (O) as an example, has a 40-basis point Overhead cost as a percentage of the portfolio value:

Source

I do not know any private real estate fund that is even nearly this competitive. Certain studies argue that cost advantages of REITs are so significant that they put REIT investors up to 4% ahead of private peers every year.

Private real estate fund sponsors typically earn a fee on all assets under management and are therefore incentivized to maximize the size of the portfolio often at the expense of the performance of those assets. The advisor might also earn a fee on all new acquisitions, developments or dispositions which may lead to more frequent trading and higher transaction costs. Finally, it is very common for external managers to earn incentive fees or “carried interest” above a certain hurdle rate that often leads to greater risk taking and excessive leverage.

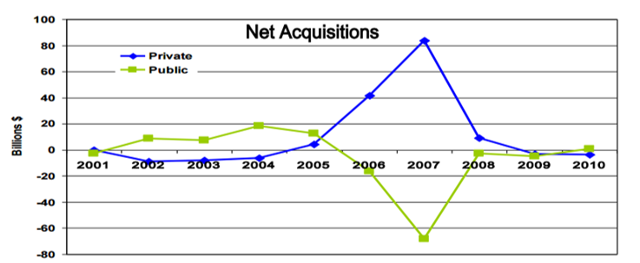

It must remain clear that at the end of the day, the external manager is running an asset management business and his interest will often not be the same as the one from the investor. In many cases, his goal might be to maximize fee income by accumulating as much assets under management (AUM) as possible which goes directly against interest of the investor. This conflict of interest is well reflected in the below graph showing the difference in transactional behavior between private equity funds and REITs leading to the financial crisis.

Source: EPRA

When prices started to be at bubble levels, REIT management teams became net sellers of real estate in 2006 and 2007 before the crash. On the other hand, private equity funds were incentivized to increase their AUM and therefore kept on buying until the crash. Conflicts of interests are real and can significantly affect investment results as seen with this historic event. In the case of REITs, interests between the management and shareholders are typically better aligned as the insiders often own a significant portion of the shares and have their salaries tied in one way or another to the underlying performance of the company. As such, by maximizing the wealth of the investors, the management maximize their own.

It is possible for an external manager to seek better alignment of interest by investing alongside the other investors, but it hardly solves the problem inherent with the typical fee structure of an asset management business. Furthermore, when discussing conflicts of interest, it could be noted that the risk of having the management take advantage of you as an investor is typically higher by an opaque private equity firm compared to a REIT which is constantly scrutinized by the public eye including many professional analysts and the SEC. If a REIT CEO performs badly, the board of directors can relatively quickly take measures. This is not as easy by a fund when an external manager has a long term contractual agreement for the management.

Another important advantage of the REIT structure as compared to private real estate funds is that REITs can create substantial value to investors by engaging in supplemental growth activities typically not available to private investors. REITs can generate external growth by raising additional equity on public markets and making accreditive property acquisition, developments, engaging in joint ventures or even initiating new real estate related businesses. As long as the REIT is able to access capital at a lower cost than the achievable expected returns, there is an arbitrage profit that the existing REIT shareholders can profit from.

Example: A REIT issues $50 million in new shares and adds $30 million in leverage for a blended average cost of capital of 6%. It then uses the capital to buy a property with an 8% cap rate. The result is a positive spread with immediate growth on a per share basis.

It boosts the growth rate of the REIT and its expected return potential, whereas private funds are generally limited to same property NOI growth to increase cash flow. This is how REITs such as National Retail (NNN), STORE (STOR), EPR (EPR), IRM (IRM) and many other are commonly able to grow at 5-10% their cash flow per year.

Private real estate funds must content themselves with much lower growth rates — leading to underperformance.

REIT may trade like stocks and have greater daily volatility, but at least you can liquidate your shares at any time, you have control over your investment, you are well diversified, prudently leveraged and the interests are better aligned in most cases.

People lie… Numbers don’t…

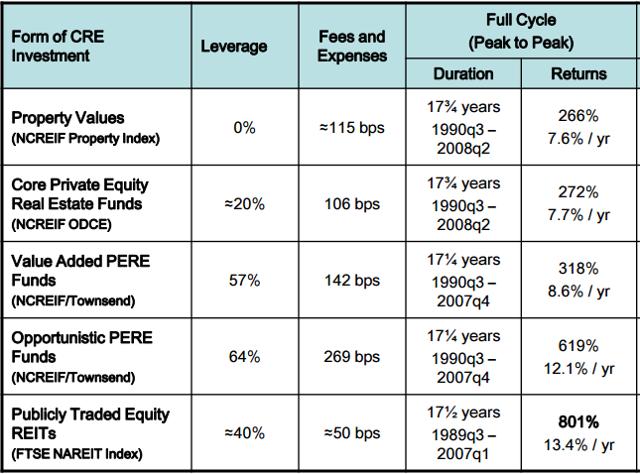

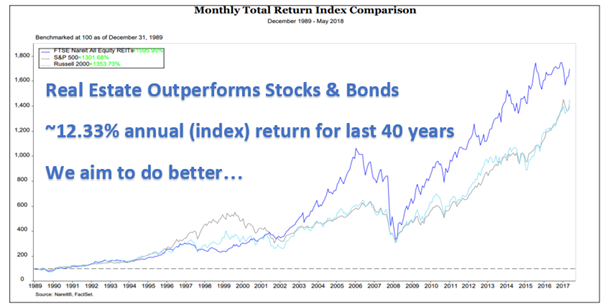

source

From 1977 until 2010, REITs have returned more than 12% per year, according to EPRA. In comparison, private real estate investors returned between 6.4% and 8.7% per year on average depending on their underlying strategy. (Core, Core+, Value-add, Opportunistic)

I used to work in the private equity real estate field myself. It is only once I learnt more about REITs that I discovered that they were much better investments in most cases than private funds which suffer from greater fees, conflicts of interest and therefore, lower returns.

I could well continue to work in private equity and earn a nice salary from these higher fees; but my passion for maximizing returns led me to becoming a REIT investor. I have no doubt that select private funds are able to outperform REITs, but to generalize that private funds are better is far from the truth when you look at the flaws of their structures and their past history of underperformance.

REIT investors have in most cases done much better by simply picking an index and never looking back. The more entrepreneurial investors who are willing to do some digging to find undervalued REITs may have done even better with some managing to generate over 20% annual returns over the past decades.

source

This is what we aim to do by specializing in REIT investing. We want to maximize our chances of generating high total returns with limited risk while remaining liquid and in control of our investment. We believe that the best way to achieve this is by investing in REITs, not in private real estate funds.

A Note about REIT Investing: To succeed as a REIT investor and earn high consistent income, we recommend to:

About High Yield Landlord

High Yield Landlord is one of the largest and fastest growing communities of real estate investors. We provide a comprehensive service ranked among the very best in uncovering high yielding securities of undervalued real estate companies. Subscription includes:

A real-money portfolio funded with $55,000 currently yielding 8.2%.

Timely buy and sell alerts for simple portfolio emulation.

A wealth of data and market intelligence on REITs, mREITs, and other real assets.

If you are looking for the newest real estate opportunities, you have come to the right place. For a 2-week free trial, click here.

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of “High Yield Landlord” – the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital – a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I am/we are long EPR, IRM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.