Lemon_tm

Lemon_tm

Ever since Facebook first presented its vision for the metaverse, and become Meta Platforms, Inc. (NASDAQ:META), the stock has dropped lower and lower, taking out a previous “bottom” almost weekly. Investors are clearly concerned about the future prospects of the social media empire, as competition with TikTok is heating up. In addition, investors do not like Meta’s aggressive investments in R&D in order to support Reality Labs and the company’s metaverse strategy.

But I beg to differ. I believe CEO Mark Zuckerberg’s push towards the metaverse is the right strategic move. In my opinion, as social media penetration globally is reaching maturity, there are only two potential outcomes for Meta: either gradually lose market share and profitability in a fierce competition with online advertising companies such as for example TikTok, YouTube, and now also Netflix; or innovate to take the lead in the race towards the $13 trillion metaverse economy.

In my opinion, being on the offensive with creative innovation in a new market always trumps competition in a mature market. And personally, I trust that Mark Zuckerberg can deliver on his ambitious goals. So far, the market disagrees. Meta Platforms stock is down some 65% from all-time highs. But I remain a confident contrarian — the more META shares drop, the more I buy.

Seeking Alpha

Seeking Alpha

On September 29, news surfaced that Meta Platforms is pushing to implement a hiring freeze and a company restructuring. Reportedly, Zuckerberg told employees that the company will need “to plan somewhat conservatively,” because the company will likely have “fewer resources to work with than hoped.”

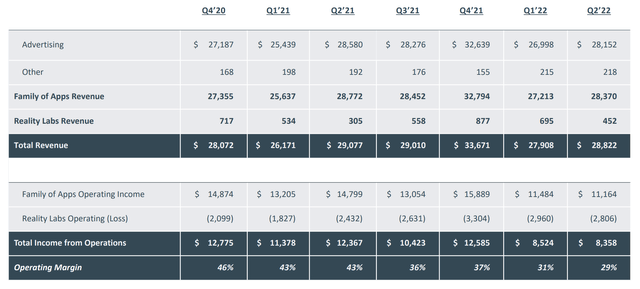

Following Zuckerberg’s communication, investors are hoping that Meta will materially reduce R&D investments in Reality Labs, as analysts have frequently highlighted how this segment pressures the company’s margins and free cash flow: for the trailing twelve months, the segment recorded a net loss of almost $12 billion on revenues of less than $2.5 billion.

Meta Q2 results

Meta Q2 results

Although as an investor I always cheer more financial discipline, I strongly disagree with the dominant market sentiment that Meta Platforms should cut funding for Reality Labs. In my opinion, reducing investments to make an already highly profitable firm slightly more profitable in the short-term will likely materially hurt the company in the long-run.

Before we can discuss why Zuckerberg’s Reality Labs ambitions make sense, it is helpful to consider why the move might be necessary.

With Facebook, Instagram and WhatsApp, Meta Platforms arguably owns the world’s most popular infrastructure for digital communication, especially for text and phone. But in the recent past, communication — and social media entertainment — has gradually moved to video.

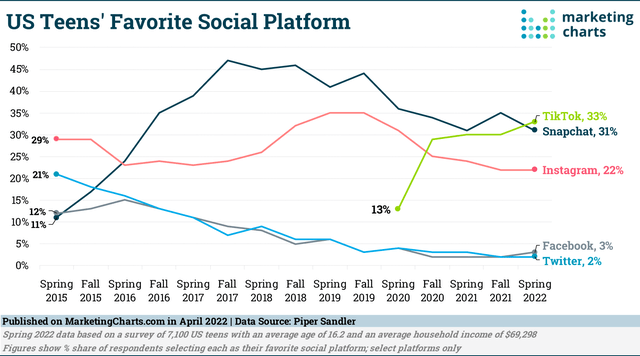

According to data provided by investment boutique Piper Sandler, only 22% of U.S. teens say that Instagram is their favorite social media platform, versus 29% in 2015. The same metric for Facebook has plummeted to 3%, from 12% in 2015.

Marketing Charts, Data: Piper Sandler

Marketing Charts, Data: Piper Sandler

Mark Zuckerberg describes it as follows: (emphasis added):

When I got started in 2004, the main medium for people to share online was text. Then we got phones… with cameras and it became primarily photos, now it is video …

That said, as compared to other platforms — notably TikTok and YouTube — Meta Platforms is somewhat lagging in the adoption of video as a primary communication and engagement tool. And thus, so the argument goes, Meta Platforms will gradually lose competitive edge.

But Zuckerberg added that the evolution of communication will inevitably continue (emphasis added):

But it is not the end of the line. There is something after text, photo and video. Communication keeps on getting more immersive.

And immersive communication is exactly what Meta is hoping to materialize through its metaverse ambition.

The metaverse is nothing else than an umbrella term for immersive experiences. As the adoption and sophistication of VR technology progresses, as it undoubtedly will, technology will fundamentally change how people communicate, play, work and learn online, with respective disruption for the social media landscape, the gaming industry, the education industry, as well as arts and entertainment sector.

Citigroup GPS Metaverse

Citigroup GPS Metaverse

McKinsey estimated that the market potential for the metaverse economy could grow to $5 trillion in 2030, as the leading strategy consultancy firm has noted strong excitement “surveying 3,400 consumers and executives on metaverse adoption, its potential, and how it may shift behaviors.”

Analysts from Citigroup (C) are even more bullish on the metaverse and its economic potential. The U.S. investment bank has estimated that the economic value of VR/AR-related applications could reach $13 trillion by 2030.

Personally, I concur with McKinsey and Citigroup regarding the enormous potential of the metaverse opportunity. And it is exciting to know that Zuckerberg still agrees as well. During the Q2 analyst call, the Meta CEO commented (emphasis added):

I feel even more strongly now that developing these platforms will unlock hundreds of billions of dollars, if not trillions, over time.

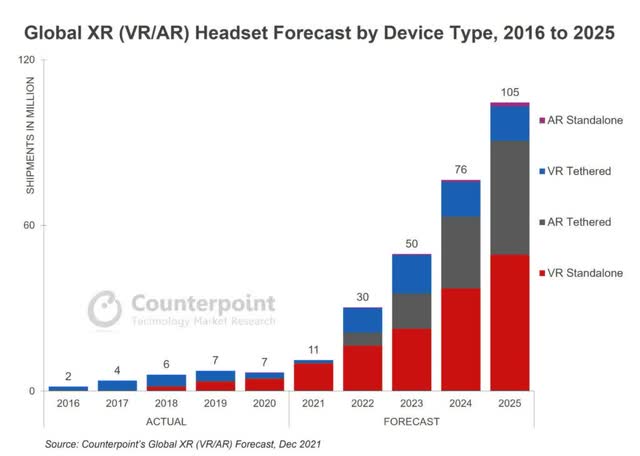

The market currently does not see the potential of the metaverse similarly strong. But is this lack of enthusiasm a function of correctly anticipating failure, or is it a function of extreme risk aversion caused by depressed economic growth sentiment? I believe the latter is the case. Consider that the adoption of VR/AR devices could exceed 100 million users by 2025, as estimated by Counterpoint.

Counterpoint

Counterpoint

In a previous article, I have argued that the market sentiment towards Zuckerberg’s metaverse strategy could turn more positive with the launch of the company’s new VR console — project Cambria — which is expected to be released in the coming weeks.

Zuckerberg’s metaverse bet is courageous. But is his ambition for social connection through VR/AR unreasonable? I do not think so. In my opinion, VR/AR is the next innovation frontier. And I believe that the market potential of the metaverse could rival the value creation materialized with the Internet revolution.

As an investor, I am glad to know that despite leading a multibillion-dollar empire, Zuckerberg still thinks like an innovator and entrepreneur. And investors should never doubt the power of entrepreneurship. Here are a few “expert opinions” on the greatest innovations of history.

1878, Sir William Preece on the telephone:

…we don’t need (a telephone)… we have plenty of messenger boys.

1927, H.M Warner on voice television:

Who the hell wants to hear actors talk?

1977, IBM executive on the PC:

There is no reason for any individual to have a computer in his home.

2007, Steve Ballmer on the iPhone:

(the Iphone) …is the most expensive phone in the world. And it doesn’t appeal to business customers because it doesn’t have a keyboard. Which makes it not a very good email machine…

In my opinion, Zuckerberg should go all in on his vision. He should not cut funding to the Reality Labs. He should add to it.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

This article was written by

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise