THE WOLF STREET REPORT

Imploded Stocks

Brick & Mortar

California Daydreamin’

Canada

Cars & Trucks

Commercial Property

Companies & Markets

Consumers

Credit Bubble

Energy

Europe’s Dilemmas

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Jobs

Trade

Transportation

The Bank of Canada hiked the target for its overnight rate for the fifth time in a row, today by 75 basis points, to 3.25%, the highest since 2008, following the 100-basis-point monster hike at the last meeting, which got everyone’s attention.

In the statement, the BoC said that its policy interest rate “will need to rise further,” as the outlook for inflation and inflation expectations remain high, and it’s “resolute” in its “commitment” to bring this inflation under control, thereby squashing any hopes for a “pause” at the next meeting.

Quantitative tightening will proceed on autopilot, “complementing increases in the policy rate,” it said. So far, total assets on its balance sheet have dropped by 24% from the peak.

How much “further” will rates have to rise? The BoC didn’t say. But it’s thinking about it:

“As the effects of tighter monetary policy work through the economy, we will be assessing how much higher interest rates need to go to return inflation to target,” it said, but didn’t mention “frontloading” this time. In other words, it’s going to be dependent on data.

And in terms of the current data, it’s interesting: The BoC downplayed the slowdown in the economy; it brushed off the dip in overall inflation, but emphasized the increase in core inflation; and it brushed off the woes in the housing market.

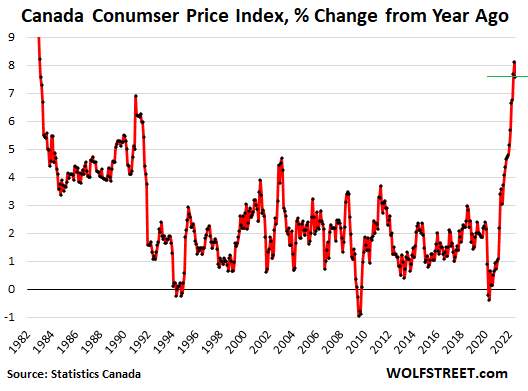

The statement said that plunging gasoline prices caused overall CPI to cool slightly from red-hot 8.1% in June to 7.6% in July, both of them 40-year highs.

But it downplayed this easing of overall CPI, and instead emphasized the increase in core CPI, driven by price pressures in services, as inflation has broadened:

“However, inflation excluding gasoline increased and data indicate a further broadening of price pressures, particularly in services.

“The Bank’s core measures of inflation continued to move up, ranging from 5% to 5.5% in July.

“Surveys suggest that short-term inflation expectations remain high.

“The longer this continues, the greater the risk that elevated inflation becomes entrenched.

Economic growth slowed to 3.3% in Q2. But the BoC downplayed it: “While this was somewhat weaker than the Bank had projected, indicators of domestic demand were very strong – consumption grew by about 9.5% and business investment was up by close to 12%,” it said.

“The Canadian economy continues to operate in excess demand and labour markets remain tight,” it said.

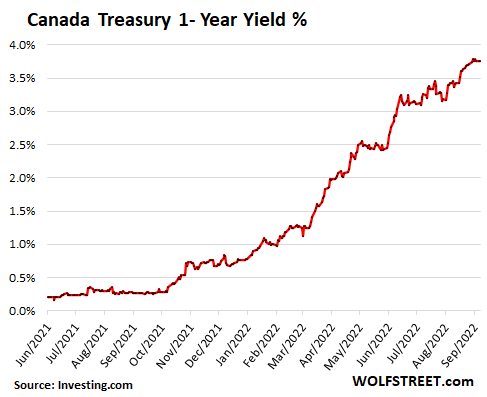

Mortgage rates in Canada have surged. Mortgages are typically variable-rate mortgages or mortgages with rates fixed for 1-5 years that then adjust, and the housing market is much more impacted by changes in short-term rates than the US housing market, where 30-year fixed rate mortgages dominate.

For example, the Canada 1-year Treasury yield has shot from about 0.25% in October last year to 3.75% today:

The pull-back in the housing market which is now causing so much hand-wringing in Canada, was “anticipated,” it said, following unsustainable growth during the pandemic.”

With the policy rate now at 3.25%, there likely won’t be another 100-basis-point monster hike. That was a July-thing to get everyone’s attention. For today’s meeting, expectations had ranged from 50 basis points to 100 basis points. The BoC hit the middle. A hike between 25 basis points and 75 basis points appear to be on the table for the next meeting in October, which would put it on track to hike its policy rate to 4% or maybe more at the December meeting.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

I would love to see the US Fed use a phrase like “unsustainable growth” to describe the insane spike in housing prices during the pandemic.

US markets remain so crazy that if Fed raises by only 50 basis points instead of expected 75 basis points, we can expect a 10% stock rally with 50 basis point dip in US treasuries and 30 year mortgage!

WA

I relate to your sentiment.

However, at the present time, the stock market ripping higher in the face of rate hikes and QT should only be viewed as temporary – yesterday was a knee-jerk reflex to many consecutive down days. This fight back will fade in the coming hours or by Friday. It is in fact pointless.

This is a stock market with far more weight on top of it than support beneath. A nailed on bear market.

A 10% stock rally is out of the question this month.

Hopefully, we follow suit…

Kudos. More pressure on the Fed to do the same.

Housing inflation in Canada has terrorized locals, especially younger people looking to buy that first home. Not sure why the Bank of Canada allowed this to happen. It seems like pure negligence.

All by design. Follow the money. The people in charge of the policies have benefited fantastically. Never before in history have the wealthy had so much.

How about when the wealthy basically owned ALL of WE the PEONs DC?

Wouldn’t that count?

Seriously, there have been many times just in the last few centuries when the ”wealthy” had life expectancies, not to mention life extravagancies, FAR beyond double that of WE the PEONs.

Good job. The bank needs to squash inflation. We need a crash before we can reboot the system.

Hosers!

This all seems a little bit late, I could never see the need for rates being lowered to levels never seen before during a pandemic. It lit a bonfire of inflated housing prices and demand around the World.

Now we have the absolute problem of currencies competing for Yield against the US dollar. Look at the Yen, AUD, Pound & Euro as they fall creating inflation. China is the next major problem in this inflation nighmare

The dollar at 110, and the stock market is back to the races today. Up on what news I have no idea except oil dipped 5%.

When the stock market started to wobble, Powell and Co. showed up in a minute to promise that they would do anything and everything to pump it up. There was nothing they wouldn’t do, even buying stocks and junk bonds if they had to.

When their deranged policies started destroying the poor, taking away their ability to even afford shelter, with inflation raging, they said that it was “transitory” and they were going to “let it run hot.” This wasn’t just reckless, it was diabolical. There is a great evil among us who are actively and intentionally hurting people.

There is not much visible evidence of a slowdown in housing yet where I live here in Canada. I do hear lots of concerns about cost of living and fears of mortgage re-financings from younger people. Not sure what will crack first, the retail sector or housing. Savers like me are happy with the increase in interest rates.

I am gonna guess a very cold winter in Toronto this year.

Any secessionist movements in AB, MB, SK and northern BC?

This is a really horrible time to be alive for people with few resources. It’s billionaires on parade while the poor lose everything.

‘All for ourselves, and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind.’

– Adam Smith, Wealth of Nations, III, iv, 448.

unamused: thank you for that quotation from a highly astute observer. Ugly as this truth is, at least we can comfort ourselves that there is nothing new in this regard today. Just perhaps more of it, and unabashed.

Comfort, Ha! More like condolence.

I agree. I am full of empathy – as I can see you are – for those whose only option is to suffer an even worse economic degradation. So many of these people work their whole lives and have little if nothing to show for it. This is just plain wrong.

“Mortgages are typically variable-rate mortgages or mortgages with rates fixed for 1-5 years that then adjust…Canada 1-year Treasury yield has shot from about 0.25% in October last year to 3.75% today.”

So, a lot of mortgage holder’s mortgage payment just shot up?

Only if you are renewing. On an existing mortgage just means more of the payment goes to interest and less to principle.

Unless of course rates climb so high that the payment doesn’t cover interest….then you have carnage.

Is this ‘variable’ interest rate claimable as a tax deduction?

No.

Not in Australia – In fact, the U.S. is the only country (I know of) where mortgage interest is tax deductible. I’m happy to be corrected.

@Valerie

In the Netherlands mortgage interest has been fully deductible for a long time. Only recently some restrictions have been introduced, like a 30 year maximum period, a cap based on the percentage of tax paid and the requirement to pay back principal.

These changes have passed virtually unnoticed in an extremely low interest rate environment, but may come to surprise some folk when mortgage rates rise.

No, Canada actually has 2 types of “variable” rate mortgages. The more typical variable rate mortgages (VRM) have steady payments unless a “trigger rate” is hit. The trigger rate is the point at which the original payment no longer covers interest on the mortgage. To prevent the mortgage balance from actually going up, payments will increase when rates go past the trigger rate. We are getting awfully close to it with some people’s mortgages now showing 90-year amortization (amortization approaches infinity just below trigger rate). The other type is more similar to American-style mortgages and is the adjustable rate mortgage (ARM). The payments on these do increase as the rate changes so amortization stays steady. ARMs are relatively rare and Scotiabank is the only major bank issuer. The rest are generally issued by monoline or “B Lenders”.

Good. Good.

Let the speculators and FOMO crowd feel the hardship like the non-asset renting class did for the past few years!

Canada is becoming a feudal society with haves and have nots.

Please note how central banks identify “unsustainable” housing price growth only when CPI is elevated. Housing prices rose 10-20% a year for a decade, yet they thought that was acceptable (if not desirable) because CPI was in the range. In fact, they refused to recognize RE prices were elevated.

Who’s responsible for such ridiculous viewpoints and results, and why are they permitted to exercise continuing economic control?

Time for a reset of monetary policy and governance.

I am surprised we Canadians did not get slapped with a 1% rate increase. It takes 2 good incomes & help from the bank of Mom & Dad & their cousin moving in & paying rent. It reminds me of life on the farm some 50 -60 years ago. multi-family living. What’s old is new again.

Buckle-up as we are just getting started.

Does this make Canada #1 among the rate-hiking G7 nations?

Yes, by a pretty good margin too.

Plus Canada’s population is among the most debt-laden and housing-dependent of the G7, so it will be interesting to see how this plays out, and how soon, relative to the other countries.

Use of interest rates to tame inflation especially when a lot of it is a supply side issue is a blunt instrument that hits only a small segment of the population especially those that can least afford it.

To tame inflation in Canada and the USA a better approach would be to increase taxes on those making big bucks.

For example, introduce a graduated income tax surcharge on people.

Say 5% on incomes over $100,000; 10% on over $150,000; 15% on over $200,000, and 25% on everything over that.

It would take a lot purchasing power out of the markets right away and limit the impact of interest rate hikes on lower income earners.

You’re kidding, right??

Those are also the income earners who invest capital in growing the economy. Economies based on redistribution stop growing.

Aye, there’s the rub.

That might be a bit extreme. The problem is all the loopholes for the top 1 to 3% – totally legal loopholes unfortunately.

Leverage will kill investors for years. Oil is wobbly because Russia is wobbly. Now, a new desperate regime will pump to fund peace and buy off the people after this disaster. Or so the market believes, meanwhile everyone keeps believing in huge inflation again.

And sanctions leak like a sieve, metals show this in spades. Why is platinum so cheap?

Mortgages cost a lot more, as Wolf keeps pointing out, so prices MUST Fall to accommodate, The Fed will quit when inflation is dead and wages moribund.

There needs to be more rate hikes to cool down the Canadian housing market.

Real estate agents were making more money than medical doctors last year!

Yes, that would certainly stop inflation. It would also destroy the jobs of most of the middle and working class.

Your email address will not be published.

Mortgage volume collapsed. And the stocks of the biggest mortgage lenders collapsed after IPO or SPAC merger.

In terms of diversification between stocks and bonds, there is none. Not anymore. They even nailed the bear market rally in lockstep.

Never a boring day in the SPAC & IPO hype-and-hoopla clown show.

The Fed’s big liabilities: reserves, US paper dollars, RRPs, and the US government checking account. Reserves already plunged by $1.03 trillion.

Interesting stuff happening in the labor market, suddenly.

Copyright © 2011 – 2022 Wolf Street Corp. All Rights Reserved. See our Privacy Policy