Petrovich9

Petrovich9

On August 1st, Valvoline (NYSE:VVV) announced that it would be selling its global products business to Aramco (Armco) for $2.65 billion in cash. Since that date, trading in the stock has been choppy, with shares lower by about 8.3%. For reference on the magnitude of the deal, Valvoline has a current market cap of about $5.0 billion, and is expected to receive about $2.25 billion from the sale, net of taxes. This is a significant transaction that will inject an enormous amount of cash into the company following the monetization of one its key assets. The transaction is expected to close late 2022 or early 2023. Given this is a cash deal with effectively no regulatory or financing concerns, the probability of closing is high.

Valvoline’s business is currently divided into two divisions: global products and retail services. The global products business accounts for most of Valvoline’s revenue, but a smaller share of its cash flow and profit. In fact, the global products business represented about 60% of company revenue in 2021 and for the fiscal third quarter ended June 30, 2022, but only 46% of adjusted EBITDA in 2021 and 44% in the third quarter of this year.

In the third quarter, retail services grew 16% year-over year, comprised of same-store sales increase of 9.9% and new unit sales of 8%. Global products sales increased 24% year-over-year, driven mostly by rising prices and increased sales volume of 9%.

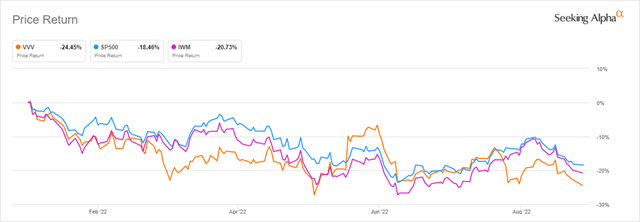

This transaction unlocks a material amount of value for shareholders that hasn’t been experienced in the company’s history. However, the market price is not reflecting the good news with the share price lower since the announcement. The stock has underperformed the broader market, down about 24% year-to-date despite sales guidance of 22-24% growth for the full-year 2022. The current P/E of 11.7x is well below the industry average of over 26x despite revenue growth in-line with peers, but with higher operating and profit margins. The current annual dividend of $0.50/share represents a current yield of 1.78% and is well-covered by earnings per share.

YTD Performance of VVV versus the S&P 500 and Russell 2000 (Seeking Alpha)

YTD Performance of VVV versus the S&P 500 and Russell 2000 (Seeking Alpha)

The sale allows Valvoline to unlock value, receiving cash net of taxes that is roughly equivalent to 45% of the current market cap. Management has stated that this cash will be used to “right-size” the capital structure by paying down a portion of the company’s $1.7 billion in total debt. The company currently holds about $100 million in cash and equivalents.

While selling the global products division will leave a much smaller remaining business, the cash injection will allow the company to return value to shareholders through share repurchases and dividends, reduce debt, and focus on operating and expanding its retail services business.

Company management expects the remaining retail services company to grow at a 20% annual compound rate while margins improve as the negative impacts of understaffing and inflation subside. Retail services will continue to expand offerings for both ICE vehicles as well as hybrids and, importantly, all-electric vehicles.

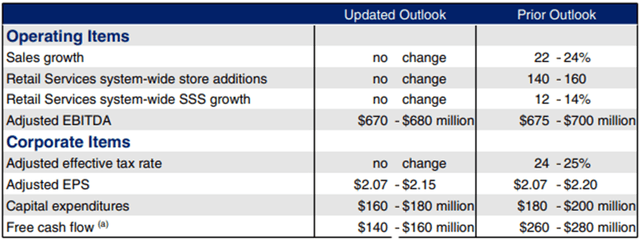

The 2022 guidance has been updated slightly following the fiscal third quarter, but remains strong on top-line growth, same-store sales growth, and margins.

2022 Full-Year Guidance (Valvoline)

2022 Full-Year Guidance (Valvoline)

Given that the deal is all-cash with a strong buyer in Aramco, this deal has a high probability of closing, likely by year-end or in the first quarter of 2023. Without this deal, Valvoline is trading at a discount to its peers as well as the broader market (both S&P 500 and Russell 2000), pays a solid dividend with more than adequate coverage, and is well-positioned for future growth. With this deal, the company will be able to unlock value, pay down debt/better manage its balance sheet, and reinvest in the future growth of the retail services business. Since the deal was announced, the stock has not reflected this positive news and the improved position of the company due to the sell-off in the broader market. Although it is reasonable to expect short-term volatility in the shares, this creates an opportunity for long-term investors seeking value. I look forward to your feedback in the comment section below.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in VVV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.