alexsl/iStock via Getty Images

alexsl/iStock via Getty Images

Tenet Fintech Group (OTCPK:PKKFF) reported its Q1 2022 financial results on May 31, 2022, with the firm reporting growing revenue.

The company operates an online network for small businesses in China and other countries.

PKKFF seems to be at a crossroads in a number of respects and presents both future opportunity and a variety of risks.

Interested investors should watch, list the stock and track its announcements which may produce volatility in the short term.

Until we gain greater visibility into the firm’s capital raising plans and business transition efforts, I’m on Hold for Tenet Fintech.

Toronto, Canada-based Tenet was founded in 2008 originally as a commercial lending platform in China, connecting small businesses with commercial lenders.

The company has expanded its focus to creating a network of online hubs providing resources to small business owners as it seeks to broaden its addressable market.

The firm is headed by CEO Johnson Joseph, who was previously President of Peak Positioning Technologies.

The company’s primary offerings include:

Tenet Business Hub

Loan and credit offers

Advertise products

Network with other business owners

Market intelligence reports

The firm acquires platform users via its website and other online marketing efforts. It is free to join the Business Hub.

According to a 2021 market research report by Allied Market Research, the market for FinTech lending was an estimated $450 billion in 2020 and is forecast to reach nearly $5 trillion by 2030.

This represents a forecast CAGR of 27.4% from 2021 to 2030.

The main drivers for this expected growth are increased efficiencies gained by lenders and greater selection by borrowers.

Also, the COVID-19 pandemic increased awareness of the use of online sourcing of funding opportunities among businesspersons worldwide.

Notably, the report forecasts that balance sheet lenders will continue to dominate the market versus marketplace lenders.

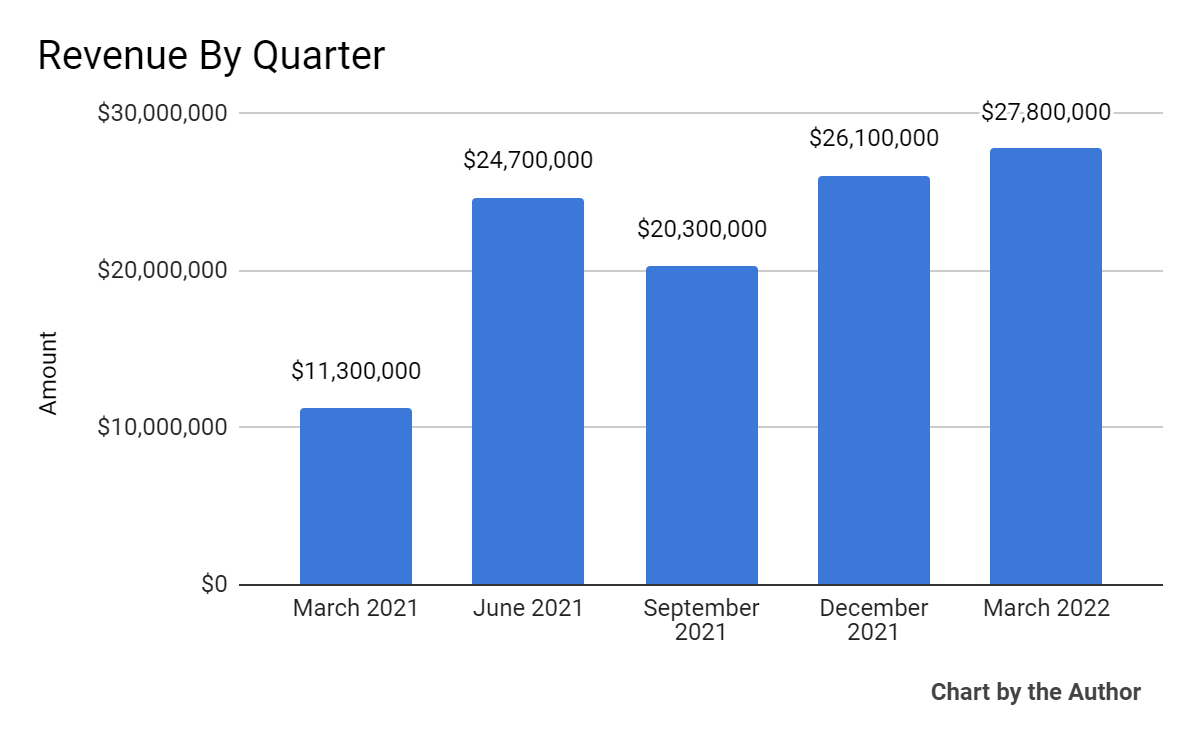

Total revenue by quarter has trended higher, albeit unevenly:

5 Quarter Total Revenue (Seeking Alpha)

5 Quarter Total Revenue (Seeking Alpha)

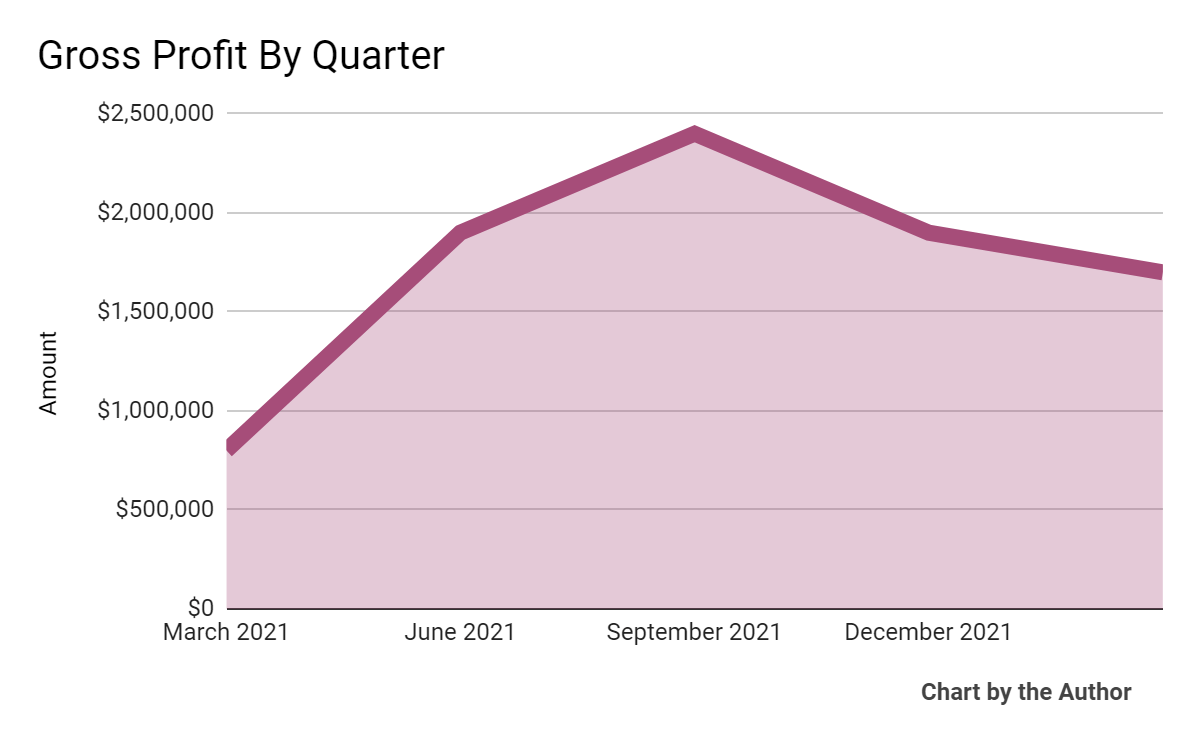

Gross profit by quarter has produced the following results:

5 Quarter Gross Profit (Seeking Alpha)

5 Quarter Gross Profit (Seeking Alpha)

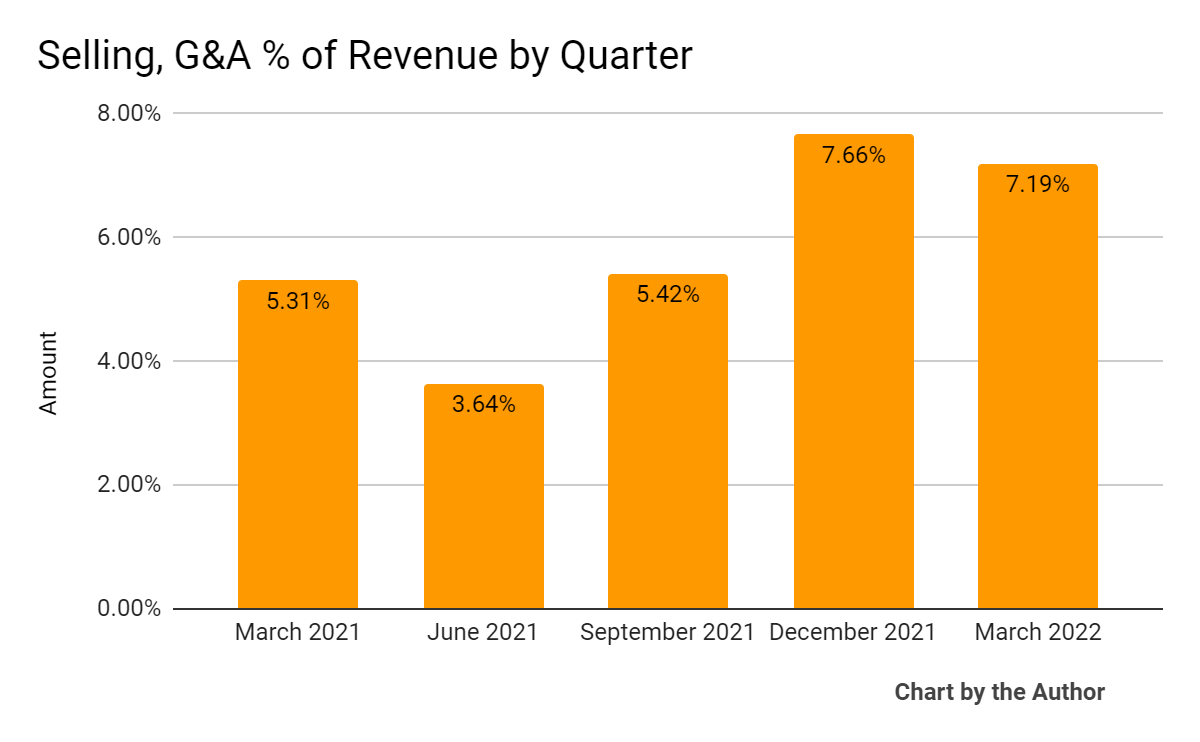

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher as revenue has increased:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

5 Quarter SG&A % Of Revenue (Seeking Alpha)

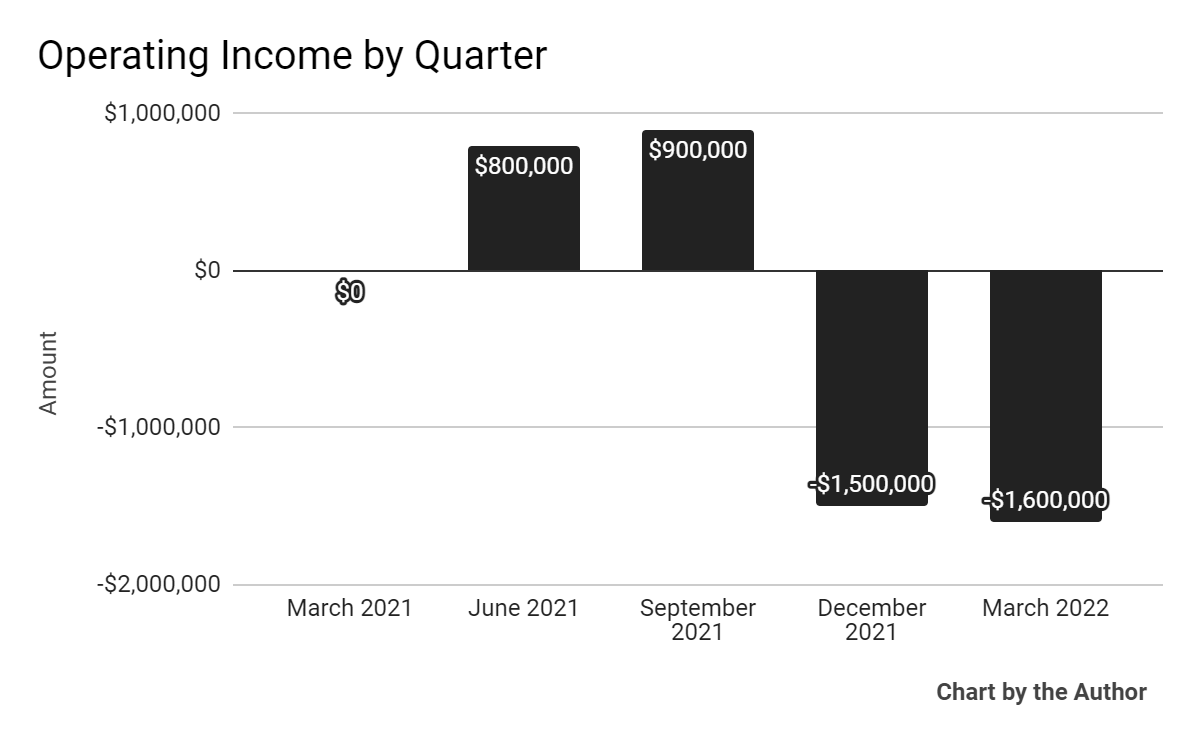

Operating losses by quarter have worsened in recent quarters, as the chart shows below

5 Quarter Operating Income (Seeking Alpha)

5 Quarter Operating Income (Seeking Alpha)

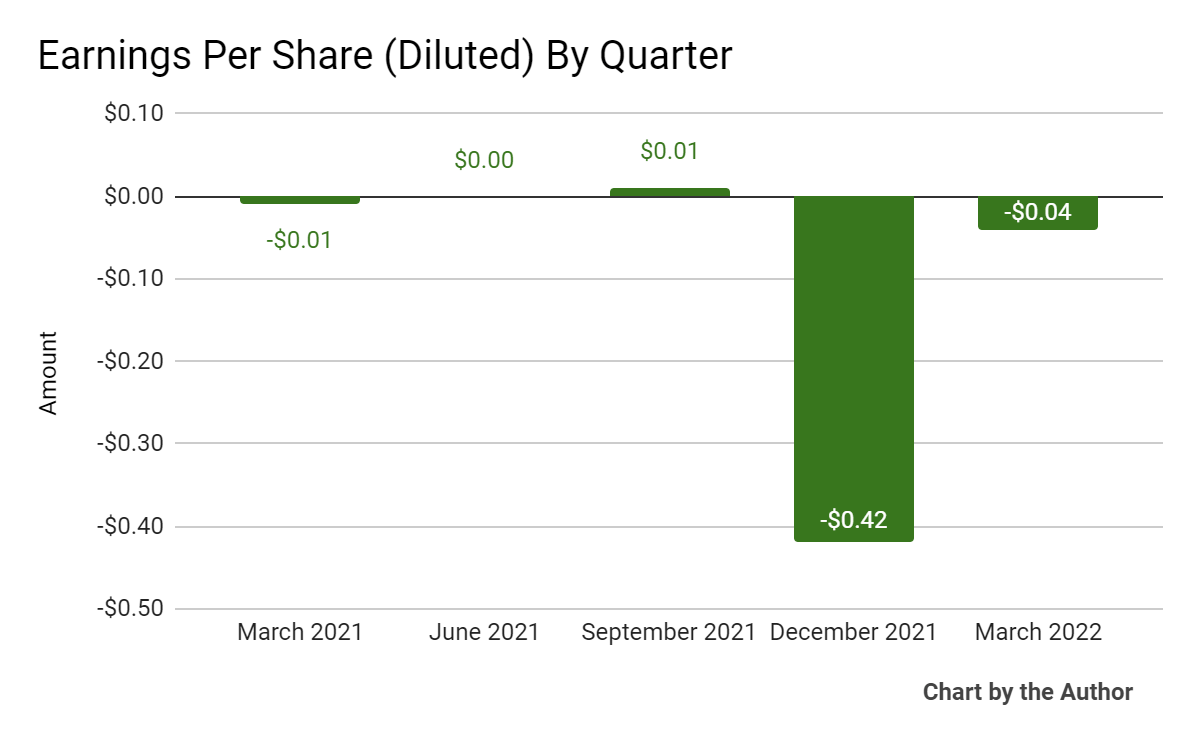

Earnings per share (Diluted) have turned negative in recent quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

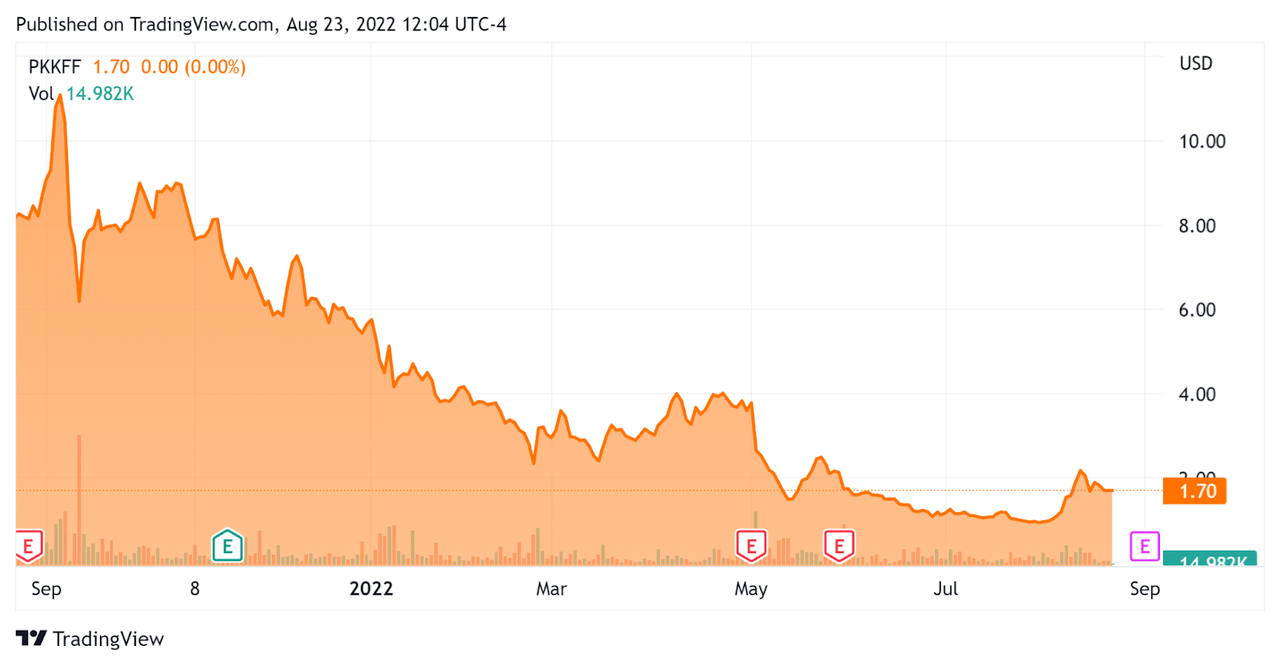

In the past 12 months, PKKFF’s stock price has dropped 79.1% vs. the U.S. S&P 500 index’ fall of around 7.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

52 Week Stock Price (Seeking Alpha)

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM]

Amount

Enterprise Value / Sales

1.69

Revenue Growth Rate

134.3%

Net Income Margin

-42.2%

GAAP EBITDA %

-0.9%

Market Capitalization

$169,580,000

Enterprise Value

$167,770,000

Operating Cash Flow

-$31,380,000

Earnings Per Share (Fully Diluted)

-$0.45

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PKKFF’s most recent GAAP Rule of 40 calculation was 133.4% as of Q1 2022, so the firm has performed extremely well in this regard, per the table below:

Rule of 40 – GAAP

Calculation

Recent Rev. Growth %

134.3%

GAAP EBITDA %

-0.9%

Total

133.4%

(Source – Seeking Alpha)

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the firm’s revenue growth in China driven by strength in its primary supply chain segment.

However, management is seeking to broaden its focus into other ‘verticals that have more interesting profit margins,’ including oil & gas, insurance and eventually clean energy.

Additionally, the firm wants to be more involved in the transfer of funds and settlement activities as well via fund transfer and payment processing services.

The company also recently launched a shipping platform called Yun Fleet so that the firm can provide shipping services as part of its desire to ‘take control as much as possible of every aspect of the transactions that go on within our business hub.’

As to its financial results, topline revenue rose by 144% year-over-year, while gross profit dropped sequentially.

However, operating income remained negative, due in part to higher salaries and remuneration and fringe benefits from labor cost inflation pressures.

The company has recently sought to list on the Nasdaq in order to access a proposed $30 million capital raise.

However, the firm’s China operations caused questions from the SEC which have served to halt the process.

Management maintains that the firm’s primary business isn’t really its China business. Instead, it is seeking to launch a business hub in Canada powered by its AI and analytics technologies, followed by future launches elsewhere.

Essentially, the firm wants to build a global SMB business social network, informing its AI and analytics engine.

A potential upside catalyst is the possibility of raising required capital in Canada or on the London Stock Exchange or other European markets.

The primary risk to the company’s outlook is its inability to raise additional capital to finance its AI and analytics-driven business social media ambitions.

Another risk is that management appears to want to transition the business toward a social network for small businesses, with a variety of service offerings powered by its AI and analytics engine.

That’s a tall order to achieve profitably at scale and one that will require significant investment capital.

Leadership is considering a wide range of investment vehicles, possibly in a tranched process, and those vehicles may or may not be dilutive to shareholders.

So, the company seems to be at a crossroads in a number of respects and presents both future opportunities and a variety of risks.

Interested investors should watch, list the stock and track its announcements which may produce volatility in the short term.

Until we gain greater visibility into the firm’s capital raising plans and business transition efforts, I’m on Hold for Tenet Fintech.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I’m the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider’s ‘edge’ on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is intended for educational purposes only and is not financial, legal or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or removed at any time without notice. You should perform your own research for your particular financial situation before making any decisions.