SDI Productions

SDI Productions

The Zoom (NASDAQ:ZM) bubble has popped – that much has been made clear after the brutal crash from all-time highs. Yet has the selloff been overdone? I am of that opinion – while the steep deceleration in growth rates since the pandemic does justify multiple compression, ZM has emerged as a highly profitable company still benefiting from secular growth tailwinds. What used to be a poster-child bubble stock is now suddenly trading at 20x earnings with a strong balance sheet. ZM is a strong buy for those looking to invest in a tech recovery.

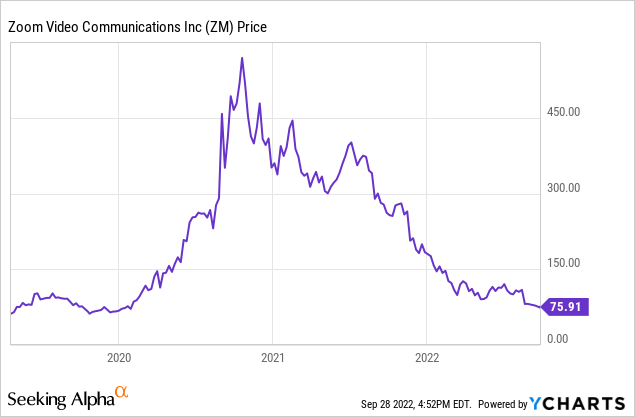

ZM peaked at nearly $600 per share in late 2020 as the business benefited disproportionately from the pandemic. The stock has since cratered over 80% and now trades lower than it did in 2019 in spite of increasing its top-line by over 5x over that time period.

I last covered ZM in October of 2021 where I rated the stock a buy in spite of the failed Five9 (FIVN) acquisition. That proved to be too early, as the stock has fallen 70% since then. Alongside falling consensus estimates, the multiple contraction has proven too steep, offering opportunistic investor an attractive buying opportunity.

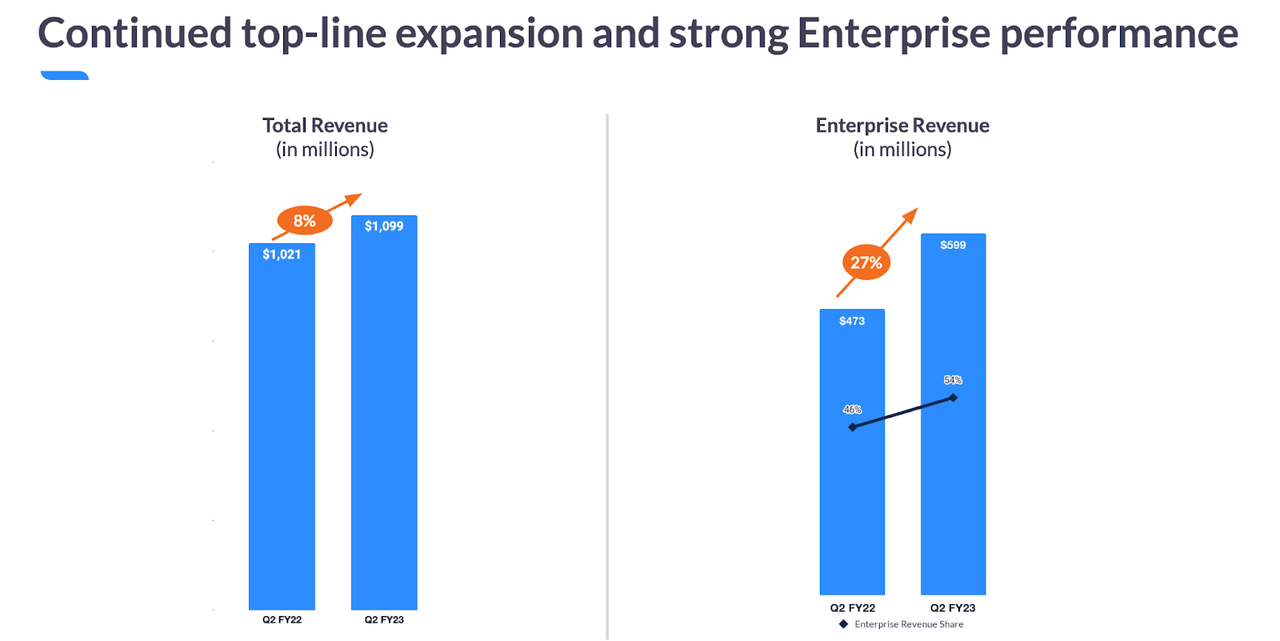

The latest quarter saw just 8% year over year growth – reflecting the full extent of the pull-forward in financial results experienced during the pandemic. On the other hand, enterprise revenue grew 27% to $599 million.

FY23 Q2 Presentation

FY23 Q2 Presentation

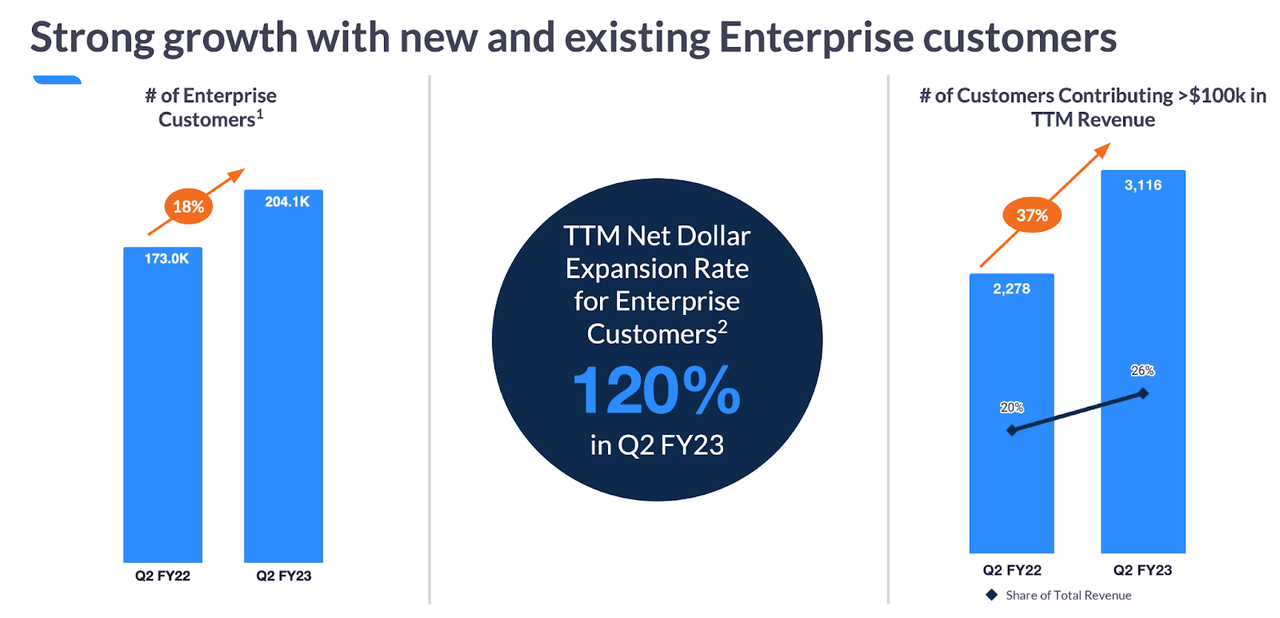

What’s more, ZM continues to add enterprise customers, generating 18% growth year over year and reporting a 120% net dollar expansion rate.

FY23 Q2 Presentation

FY23 Q2 Presentation

The difference between enterprise customers and the rest of its revenue base is that ZM also has an “online business” which refers to customers using the product on an individual basis. Perhaps many smaller entities used ZM as a temporary fix during the pandemic and were not quite prepared to make a long-term transition to video conferencing. With the pandemic in the rear view mirror, those customers are leaving the platform.

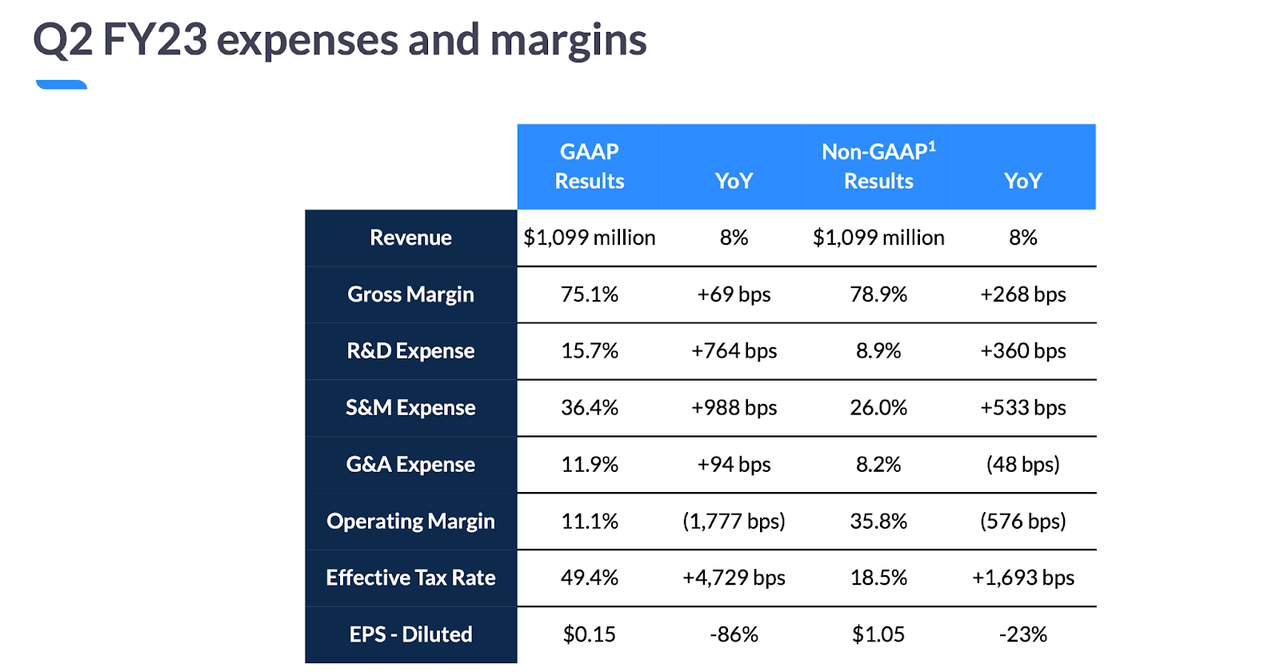

ZM generated positive GAAP profits, but did see GAAP operating margins decline by 1,777 bps and non-GAAP operating margins decline by 576 bps.

FY23 Q2 Presentation

FY23 Q2 Presentation

On the conference call, management noted that it is investing heavily in R&D with an ultimate goal to reach a long-term target of 10% to 12% of total revenue. R&D stood at 8.9% of revenue on a non-GAAP basis in the latest quarter.

Management did note that revenue results were “disappointing and below expectations,” with the primary culprit being low growth and low retention in its online business.

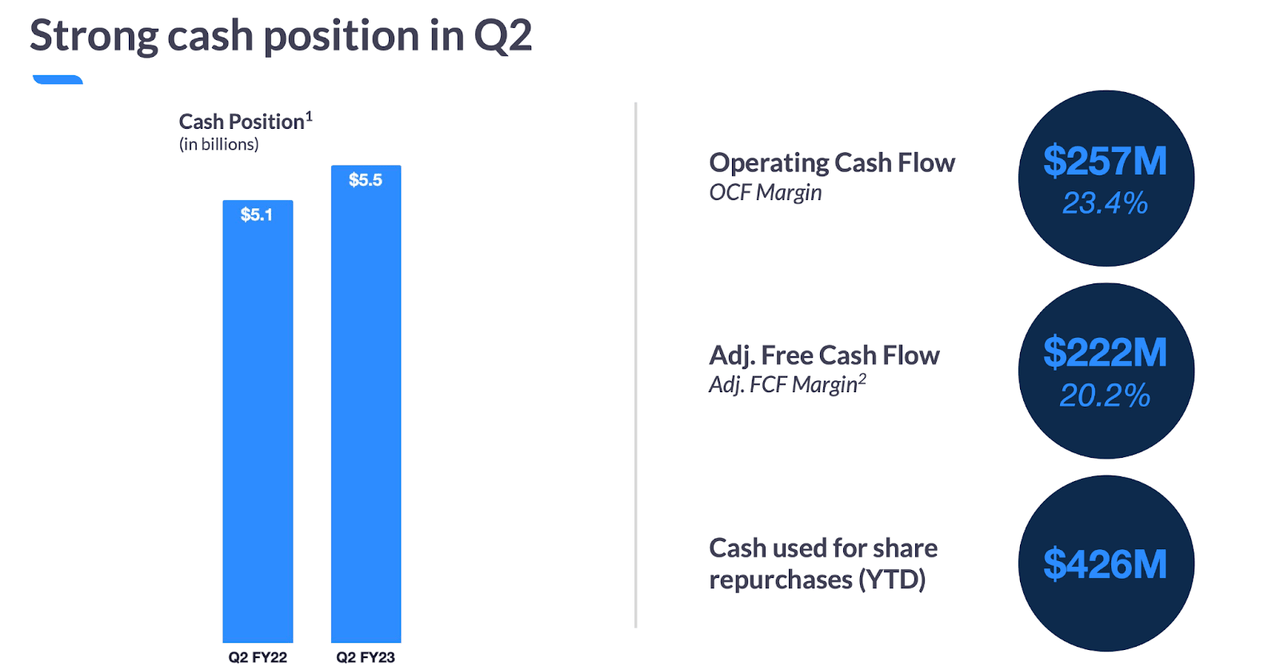

ZM ended the quarter with $5.5 billion in net cash (representing 25% of the market cap) which together with the strong free cash flows represents a strong balance sheet position.

FY23 Q2 Presentation

FY23 Q2 Presentation

At its recent Citi investor conference, management outlined its plans to return the Online segment to growth. That is key to the thesis because whereas Enterprise is expected to grow at a 20% rate this year, the Online segment is expected to show year over year declines. The plans include increasing its free-to-pay conversion. ZM had previously put a time limit cap on one-to-one meetings earlier this year (it had previously been unlimited), which has had a positive impact on conversion rates. That said, management noted that many users have responded to those changes by running back-to-back-to-back meetings, enabling them to effectively host a long meeting without paying for a premium plan (clever, isn’t it?). Management hinted at an additional cap on the number of meetings per day to address that issue.

Regarding Zoom Phone, management believes that it can reach around 25% of revenue over time. The company does not currently break out Zoom Phone revenues but noted that it will do so once it hits 10% of revenue – which should be a matter of quarters, not years.

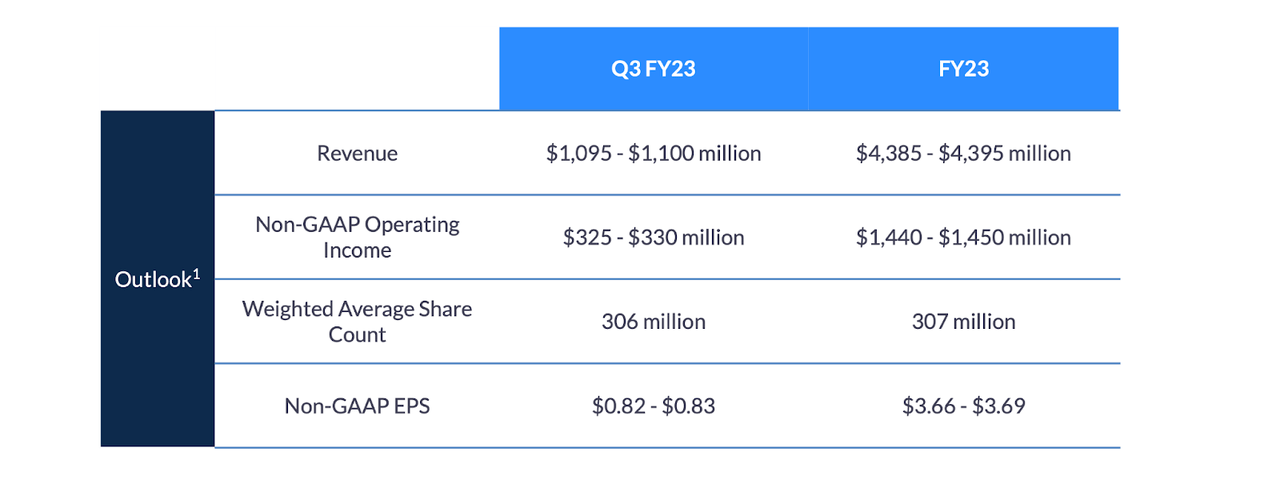

Looking ahead, ZM guided for up to $1.1 billion in revenue in the third quarter, representing 4.8% year-over-year growth and an implied 4.8% growth rate in the fourth quarter as well.

FY23 Q2 Presentation

FY23 Q2 Presentation

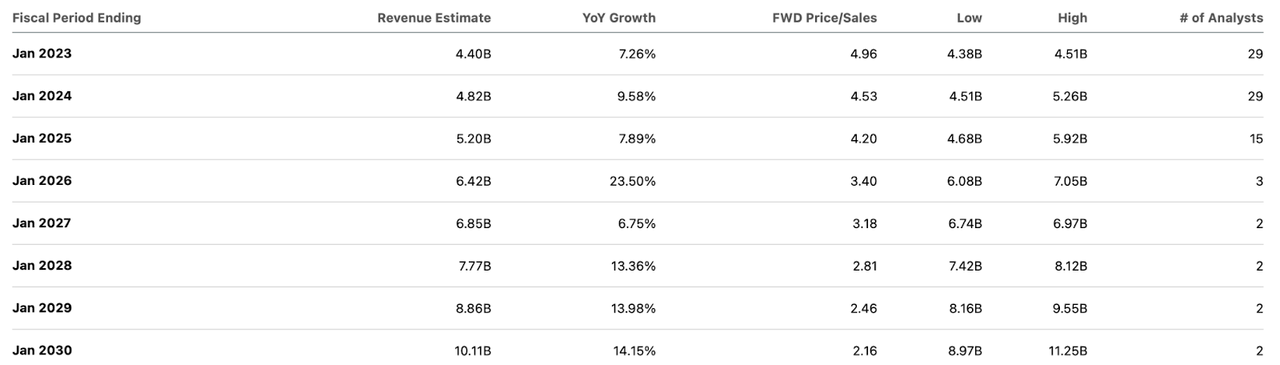

ZM once traded to the stratosphere but is now a stock trading at 20x forward earnings estimates. Consensus estimates call for growth to return next year.

Seeking Alpha

Seeking Alpha

As stated previously, margins have been contracting. At its Deutsche Bank investment conference, management stated that they will give a new long-term target operating margin in November. They had previously targeted at least 25% but saw operating margins rise above 40% during the pandemic. Management stated that margins rose primarily due to business increasing faster than they could increase investments in R&D. As ZM ramps up R&D, the company expects some margin contraction, but stated that they are “not going to let margins just continue to drift.”

Some investors might wonder why stock-based compensation remains so high – in spite of the falling stock price, stock-based compensation more than doubled to $262 million in the quarter. Management noted the following:

So employees that joined us a year and a half ago, when the stock was $300 and $400, the number of RSU they got when they rolled into their one year anniversary, and they take the new stock value times that number are huge. It’s less than what they got in their offer letter. And we don’t want them to be worried about that. And so we have a program right now, that for employees on their one year, and their two year anniversary, if the value of their RSUs is not equal at that anniversary date is not equal to what was in their offer letter, we are giving them top up grants at that point in time.

That commentary is not positive for shareholders, but may end up being the right decision in the long term as it enables the company to retain top talent. It also should not continue indefinitely assuming the stock stabilizes around here.

It’s worth noting that if one assigned zero value to the Online business, then the Enterprise business is trading at just 9.2x sales, and that is before accounting for the 25% net cash position. That is not an unreasonable multiple as compared with the 20% growth rate and strong profit margins.

On the whole, I could see ZM achieving at least 35% GAAP net margins and return to 15% growth over the long term. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), fair value might be around 8x sales, implying a stock price of $120 per share or 60% potential upside.

There are two key risks to the thesis. First, it is possible that the market has become saturated and growth will not return to the projected 15% level. Second, competition – especially that from Microsoft Teams (MSFT) – may eat into the growth and margin outlook. While ZM offers a compelling product, it is not easy to refute the notion that MSFT can take over given their long history in the space. That means that even though ZM is producing profits today, the risk profile might be elevated if it begins losing market share to Teams.

As discussed with subscribers of Best of Breed Growth Stocks, I am investing in a diversified basket of beaten down tech stocks as my favored strategy in the current environment. ZM fits as a medium risk position, as the secular growth and strong profit margins are offset by the threat of competition from Microsoft Teams. I rate ZM a buy – while the stock is unlikely to return to all-time highs soon, if ever, there is plenty of upside potential to be had to make this a compelling pick.

Growth stocks have crashed. The time to buy is when there is blood on the streets, when no one else wants to buy. I have provided for Best of Breed subscribers the 2022 Tech Stock Crash List, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Disclosure: I/we have a beneficial long position in the shares of ZM, MSFT, FIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks portfolio.