Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Motley Fool Issues Rare “All In” Buy Alert

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Real estate investment trust (REIT) acquisitions have been red hot over the last few years. In July, Nareit, the national association of REITs, said that 25 REITs had merged or been acquired since the beginning of 2021.

The latest REIT to join the acquisition club is retail net lease REIT Store Capital (STOR 0.85%). Earlier this month, the company announced that it entered into a definitive agreement to be acquired by global investor GIC, in partnership with net lease investment firm Oak Street.

While the acquisition isn’t complete yet, here’s what it could mean for investors.

GIC and Oak Street are set to purchase Store Capital for $14 billion. Shareholders would receive $32.25 per share, which is a 7% premium at the time of this writing and a nearly 18% premium from Store Capital’s 90-day average. The closing is contingent on approval by Store Capital’s shareholders and other customary closing conditions. If approved, it would finalize in early 2023.

The current offer was unanimously approved by Store Capital’s board of directors; however, there’s a chance the company receives a better offer. The agreement includes a 30-day “go-shop” period that ends Oct. 15. During this window, the company can solicit alternative proposals that could better benefit shareholders and the company.

GIC and Oak Street’s offer of $32.25 per share is around 14 times its projected adjusted funds from operations (AFFO) for full-year 2022 — which is hardly a premium. For example, the Blackstone Group‘s acquisition of data center REIT QTS Realty, which closed in August 2021, was sold at 26 times its projected FFO for the full year. Although, it’s worth noting multiples are tighter this year given rising interest rates and the shaky economy. Plus, the companies operate in different industries meaning the retail industry may not receive the same premium pricing as data centers.

There’s a chance Berkshire Hathaway makes a better offer, as the company already owns around 9.8% shares outstanding in Store Capital. However, no news has been shared regarding that possibility. Currently, the net lease REIT has roughly 3,000 single-tenant retail properties in its portfolio across a wide mix of industries from restaurants, manufacturing, child centers, and many others.

The stock jumped nearly 18% once the announcement was made. For now, Store Capital shareholders are in a period of wait and see. If the company receives a better offer, there could be a small window when an investment in Store Capital now is still profitable before its closing. But that window is narrow, and there’s no guarantee the company will receive a higher premium.

As for current shareholders, this deal means they will eventually be left with one less income stream. This is certainly disappointing given Store has raised its dividends nine times in the past seven years for a total increase of 238%. The REIT will maintain its third-quarter cash dividend of $0.41 per share, but it will pause any dividend payments thereafter until closing.

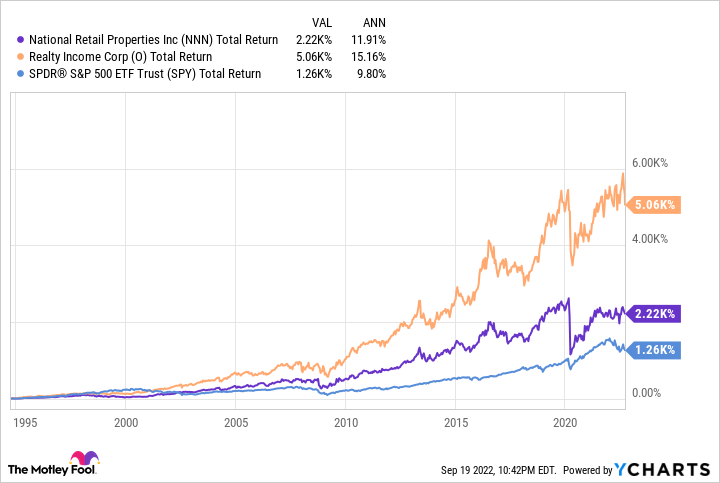

Thankfully, Store Capital is not the only single-tenant net lease REIT in the business. National Retail Properties (NNN 2.33%) owns and leases roughly 3,200 properties in 48 states. The company, like Store Capital, has done tremendously over the years, producing an 12% return, outperforming the S&P 500 for the past 25 years.

NNN Total Return Level data by YCharts.

There’s also Realty Income, the largest net lease REIT in the world, having interest and ownership in over 11,400 properties across an incredibly diverse range of industries. Realty income and National Properties Trust are both Dividend Aristocrats, having maintained 25 years or more of dividend increases. At recent prices, Realty Income’s yield is around 4.6% and National Retail Properties offers a 4.8% dividend yield.

Liz Brumer-Smith has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway (B shares), Blackstone Inc., and STORE Capital. The Motley Fool recommends the following options: long January 2023 $200 calls on Berkshire Hathaway (B shares), short January 2023 $200 puts on Berkshire Hathaway (B shares), and short January 2023 $265 calls on Berkshire Hathaway (B shares). The Motley Fool has a disclosure policy.

*Average returns of all recommendations since inception. Cost basis and return based on previous market day close.

Market-beating stocks from our award-winning analyst team.

Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Returns as of 09/29/2022.

Discounted offers are only available to new members. Stock Advisor list price is $199 per year.

Calculated by Time-Weighted Return since 2002. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

Market data powered by Xignite.