CHUNYIP WONG

CHUNYIP WONG

SL Green Realty Corp. (NYSE:SLG) is a great REIT for investors who are looking for stable income during a period of uncertainty. We believe that the company’s portfolio of NYC commercial real estate is attractive during this time, as companies continue to bring back workers to offices and as more and more start-ups and technology companies migrate to NYC. Company management also has a proven track record of shareholder value creation, with high monthly dividends and generous share buyback programs. We believe that SL Green Realty’s stock can protect your capital while providing substantial dividend income.

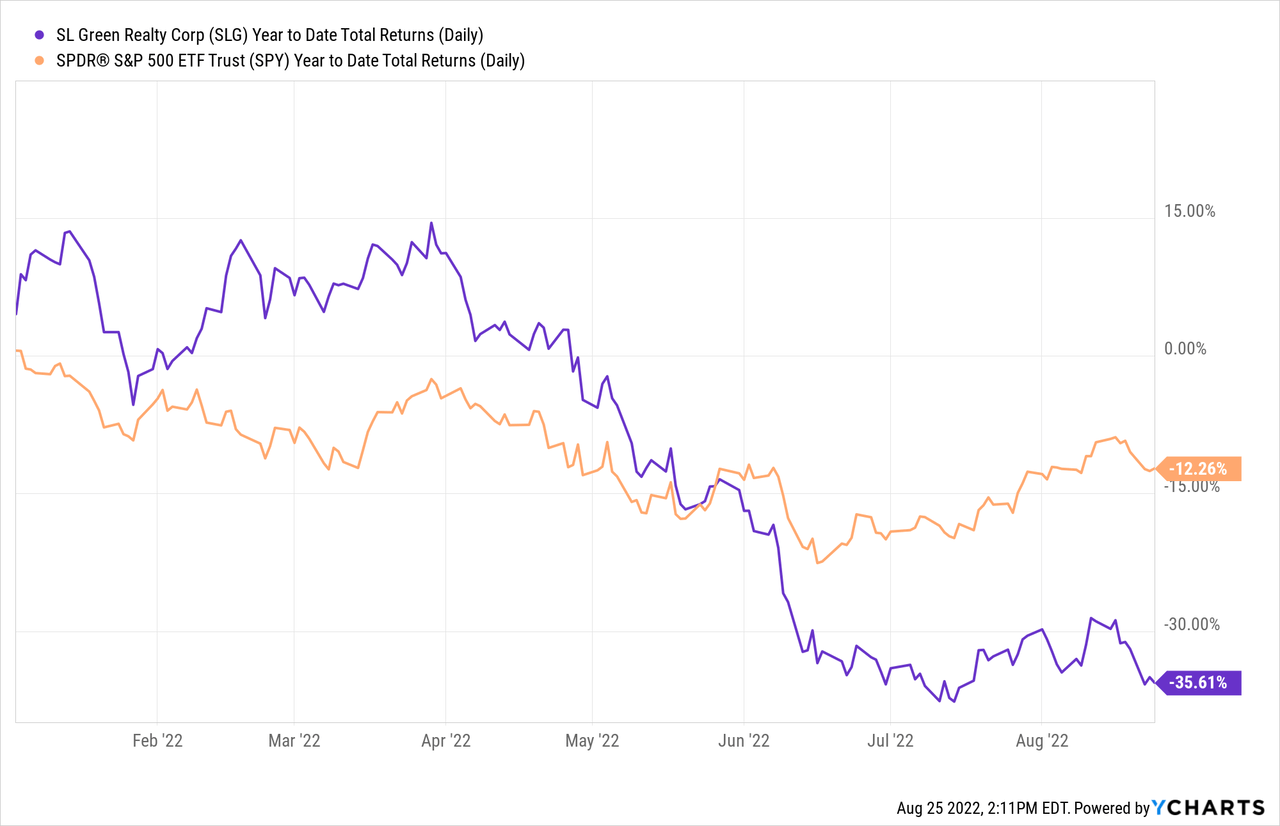

SL Green Realty Corp is a real estate investment trust (REIT) that specializes in the acquisition, management, and value enhancement of Manhattan commercial properties. SL Green Realty has more than 64 builds as the end of 2022 Q2, and has investments in more than 34.4 million square feet. The company operates iconic buildings such as the newly developed One Vanderbilt and other iconic NYC buildings like 1350 Avenue of the Americas. The stock’s performance has been poor year-to-date, generating a YTD return of -35.61% compared to S&P 500’s return of -12.26%. The company has a market capitalization of $2.88 billion, and is 47.5% down from its 52-week highs.

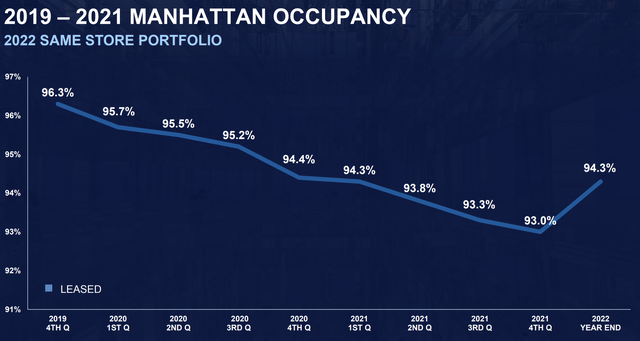

The pandemic has largely subsided, and though it is hard to argue that work environment will come back to what it once was during the pre-pandemic period, we believe that there will be a continued need for office space as companies incorporate a hybrid work environment and/or create spaces to incentivize workers to come back. Many financial services companies already require workers to work in the office for at least part of the week (with some requiring coming to office all five days of the week), but recently, there has been a move by technology companies to require workers to come back to work. We believe that this trend will likely continue as employers see the merits of at least some partial in-office work environment. This trend will continue to support high occupancy rates in SL Realty’s portfolio, and we already see this bounce back in occupancy rates below, based on management’s estimates for 2022 year-end.

2021 Investor Presentation

2021 Investor Presentation

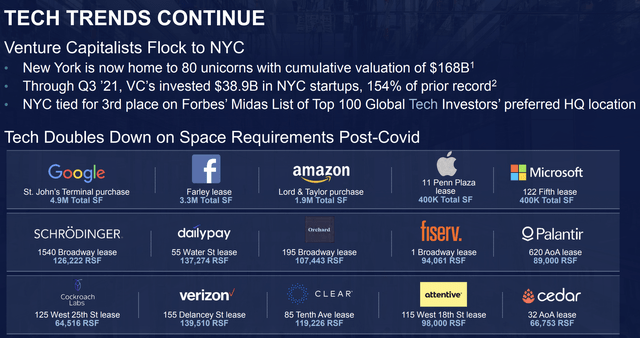

SL Green Realty is a perfect play on the continued need for office space and other commercial space in New York City, more specifically Manhattan. Unlike other REITs, SL Green Realty is heavily leveraged toward the fortunes of Manhattan, and we believe that the company is well-poised to reap the benefits of continued office expansion and need for space in NYC. For example, Manhattan has seen an influx of tech companies moving in, in addition to the creation of startups in the city – even giving rise to an area known as “Silicon Alley”. The expansion of the tech scene in NYC will provide strong fundamental demand for office space in the long-term, as some of these start-ups will continue to grow and increase its need for commercial space accordingly. Even though the macroeconomic environment has recently been unfavorable toward technology companies, we believe that in the medium-term, tech companies will continue to grow and support our thesis. Though many start-ups may fail if the current economic situation worsens, we believe that there will be other start-ups that survive and grow into large technology companies.

2021 Investor Day Presentation

2021 Investor Day Presentation

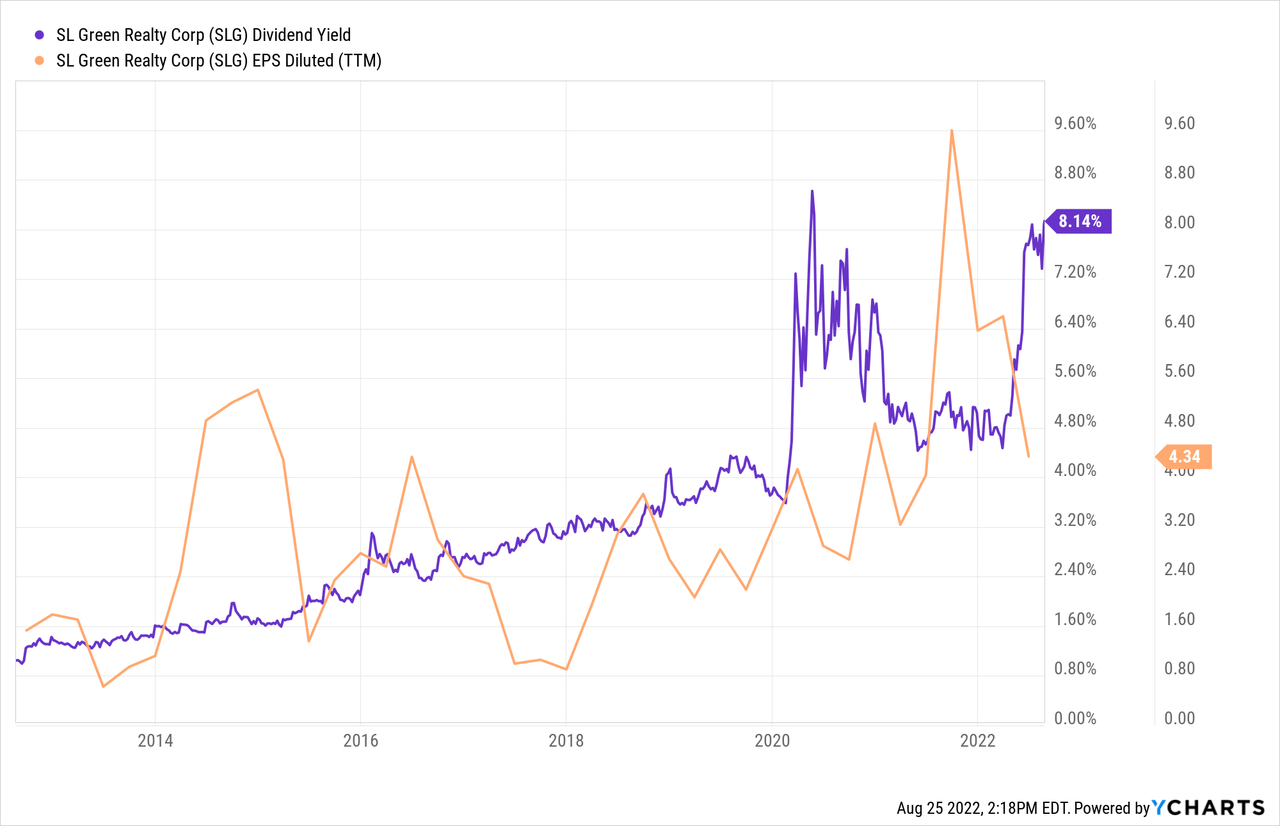

SL Green Realty has had a history of friendly shareholder policies through the form of high dividends and generous share buyback programs. The company has paid out $3.72 in the trailing twelve months, corresponding to a dividend yield of 8.3% based on current stock price. The company also pays monthly dividends, which should please investors as the stock can provide a stable, recurring monthly income for income-focused investors. The company has also seen a dividend growth of 21.63% on average, which far outpaces the dividend growth of many major benchmark indices. In addition to the dividend, the company has often engaged in various share buyback programs that amount to $3.5 billion. These programs have significantly reduced the shares outstanding, from ~96 million shares in 2017 to ~64 million shares today. The impact of these share buyback programs is considerable as even with constant earnings, the value of each share has increased significantly as a result of the company’s share repurchase programs. We believe that the combination of high dividends and frequent buyback programs make this stock extremely attractive in this environment.

We believe that outside of macroeconomic risks, the main risk to SL Green Realty’s business model is potential exodus of corporations to other locations such as Florida and Texas. For example, previously NYC dominant companies like J.P. Morgan and Morgan Stanley have built their second headquarters out of New York, and we believe that this sort of trend could threaten the company’s New York based real estate model. It is possible that in the long-term, companies previously based in New York may continue to relocate jobs out of the state and therefore require less commercial space than before. However, such fear has yet to be shown on the company’s lease operations results, and we believe that the growing start up economy and expansion of large tech presence in the city can help offset any reduction in commercial space needs by traditional NYC based companies.

SL Green Realty is a great investment for investors who are looking for a balance of dividend and capital protection. We believe that SL Green Realty has an attractive portfolio of NYC commercial real estate that could benefit from return-to-office trends and the growth of technology companies and start-ups in New York. The company also has generous dividend and share buyback programs that can provide solid income stream while protecting shareholder value for long-term investors.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.