Drazen_

Drazen_

Starwood Property Trust (NYSE:STWD) was the first REIT I invested in. While there were many quality REITs I was considering, a speech by Barry Sternlicht, STWD’s CEO, sealed the deal for me. If you have never listened to Mr. Sternlicht speak, I suggest listing to this interview from Capital Allocators featuring Barry Sternlicht. STWD is a hybrid mREIT that operates a commercial lending segment, a property portfolio, Real Estate Investing & Servicing, Residential Lending, and Infrastructure financing. STWD has deployed over $91.4 billion since its inception in 2019, and has a current portfolio of $26.9 billion across its business segments. Over the years, STWD has grown its loans and lease receivables and its net interest income while maintaining its large dividend of $1.92 per share. When I invest in REITs I am looking for them to just trade sideways and generate a large yield that I can reinvest to grow my share count and my future projected income. STWD has done this in spades, and the power of compound interest has made STWD a great income investment over the years for me. In this article, I will go through the numbers and illustrate how my investment has grown and what the future potential could become.

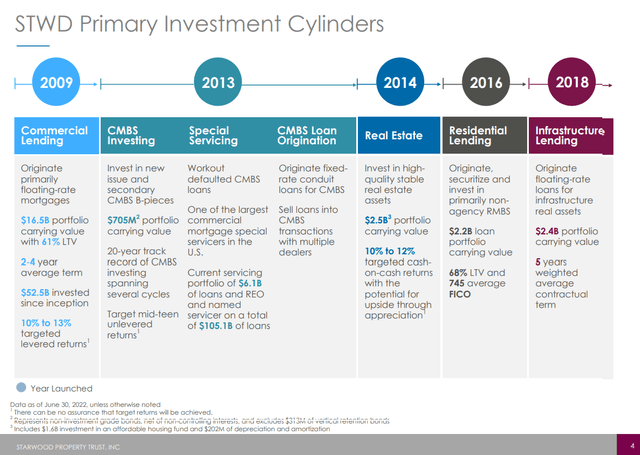

STWD is an mREIT that is focused on originating, acquiring, financing, and managing mortgage loans and other real estate investments in the United States, Europe, and Australia. STWD has four main reportable business segments, which include commercial and residential real estate lending, infrastructure lending, real estate property, and real estate investing and servicing. The commercial and residential real estate lending segment focuses on originating, acquiring, financing and managing commercial first mortgages, non-agency residential mortgages, subordinated mortgages, mezzanine loans, preferred equity, commercial mortgage-backed securities, residential mortgage-backed securities, and other real estate and real estate related debt investments. Infrastructure lending engages in originating, acquiring, financing, and managing infrastructure debt investments. STWD’s real estate property segment acquires and manages equity interests in stabilized commercial real estate properties, including multifamily properties and commercial properties subject to net leases, that are held for investment purposes. STWD’s real estate investing and servicing business acquires and manages unrated, investment grade, and non-investment grade rated CMBS, including subordinated interests of securitization and resecuritization transactions.

Starwood Property Trust

Starwood Property Trust

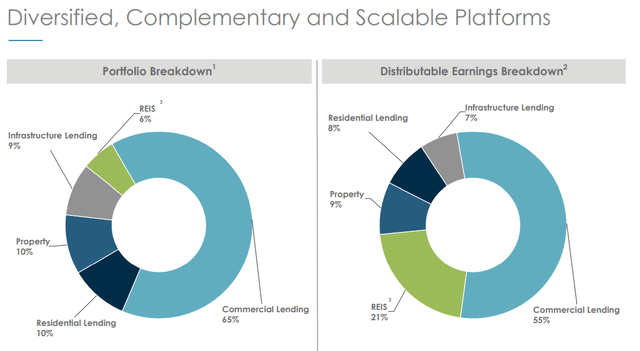

STWD’s largest segment is its commercial lending, as it represents 65% of its portfolio and 55% of the distributable earnings generated. Commercial lending has roughly a $16.5 billion portfolio and targets 10-13% levered returns. Real Estate Investing and Servicing is STWD’s highest margin business segment as it represents 6% of its portfolio but generates 21% of its distributable earnings. STWD’s real estate segment has a $2.5 billion portfolio and targets 10-12% cash on cash returns with the potential for capital appreciation.

Starwood Property Trust

Starwood Property Trust

Over the past 6 years, since I have been a shareholder of STWD, its done a good job of growing several key metrics within its financials. STWD’s net interest income has grown by $149.4 million, or 48.63%, as it increased to $456.6 million. STWD has increased its long-term investments by 1.55 billion (152.69%) and its loans and lease receivables by $12.01 billion (204.2%) over this period. STWD’s loans held for sale have also increased from $63.3 million to $2.24 billion. STWD currently has $7.1 billion in equity on its books, and each share has a book value of $20.68. STWD’s market cap trades at a -3.31% discount to its equity, and its overall share price trades at a 3.41% premium to its book value. STWD’s metrics indicate that it’s successfully allocated capital during the pandemic as many critical numbers continue to grow. STWD trades close to its book and equity levels, indicating that a significant premium could be achieved when the economic environment improves.

STWD was the first REIT I invested in. The determining factor was Barry Sternlicht, as I had watched a speech he delivered and decided I wanted to be invested in the company he was the CEO of. I will show all of the figures from my investment in STWD and how this position has grown over the years.

At the end of 2016, I purchased 135 shares of STWD at $22.66 for $3,059.07. At the close on 9/23, STWD traded for $21.41, which is a decline of -5.52% over the previous 6 years. While STWD’s share price has declined by -5.52%, I am up 58.64% on my initial investment. Through reinvesting each dividend and harnessing the power of compound interest, my share count has increased by 67.93%, my quarterly dividend payment has increased by 63.14%, and my future annual cash flow has increased by 67.93%. I will walk you through all of the numbers as it will illustrate why I love dividend investing.

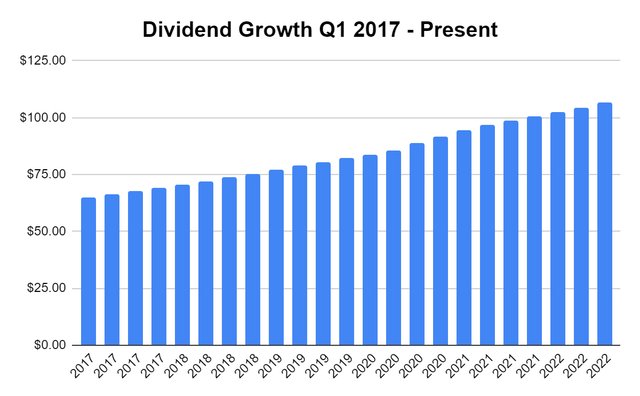

I collected my first dividend in Q1 of 2017. The initial 135 shares of STWD generated a $64.80 dividend which was reinvested. Since my initial investment, STWD has produced 23 quarterly dividends, and I have reinvested all of them. Over the next 22 dividends, STWD paid, my quarterly dividend increased from $64.80 to $106.43. Through the power of compounding, my quarterly dividend income grew by $41.63 (64.24%). My average quarterly dividend increase has been $1.89 or 2.28%.

Steven Fiorillo

Steven Fiorillo

Over the past 6 years, my initial share count has grown by 91.7 shares (67.93%) from 135 to 226.70. While STWD’s share price is down -5.52% from where my initial purchase was, my current share amount of 226.70 (in this account) is worth $4,853.65. I am up $1,794.57 (58.66%), while my projected annual income has increased by $176.06 (67.93%) from $259.2 to $435.26.

If history repeats itself over the next 6 years and my share count grows by another 67.93%, I will add 153.99 shares, bringing my total shares to 380.69 in 2028. Assuming STWD’s dividend stays at $1.92, my future annual dividend income would be $730.92, which would be an increase of 67.93% or $295.66. Hypothetically, if this occurred another 2 times, my share count would increase by 67.93% by 2034, and then again by 2040, I would amass over 1,000 shares from my initial purchase of 135. Staying with these numbers, I would have 639.27 shares in 2034, paying $1,227.41 in annual dividends, and 1,073.51 shares in 2040, paying $2,061.13 in annual dividends. This is why I love dividend investing over long periods of time; as long as the stock has a high yield and just trades sideways, compound interest can turn it into a great investment if you have enough time on your side.

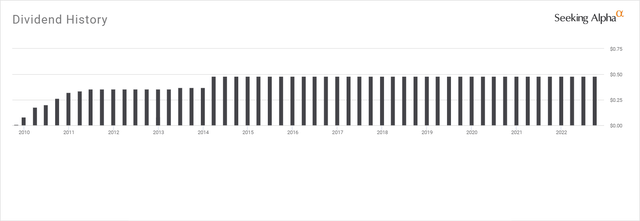

Since STWD’s inception in 2009, its paid a quarterly dividend without cutting or reducing the dividend. STWD went public during the financial crisis and managed to increase its quarterly dividend 7 consecutive times from Q4 2009 to Q2 2011. In 2013 STWD provided an additional quarterly increase, then in 2014, STWD raised its quarterly dividend to $0.48, bringing its annual dividend to $1.92. STWD has paid 35 consecutive quarterly dividends of $0.48, establishing a strong track record.

STWD is a great example of how reinvesting dividends and allowing compound interest to work its magic can become a lucrative income investment. Excluding the pandemic crash, STWD has traded in a range that hasn’t deviated too much in either direction. I haven’t received a dividend increase from STWD, but my quarterly income has increased on average by $1.89 or 2.28% due to reinvesting the dividends. Utilizing STWD’s income stream to increase the value of my overall investment and grow my future dividend income has worked well. Based on STWD’s dividend chart, I am expecting the next 6 years to produce similar results.

Seeking Alpha

Seeking Alpha

STWD has been one of my favorite dividend investments as my invested capital has grown along with my projected dividend income. I am glad that I never added to STWD in this account, as I am able to accurately track all of the investment metrics. Dividend investing may sound boring to some, but I look forward to getting additional income every 3 months from STWD, reinvesting it, and growing my future income stream. My asset base and dividend income have both grown by 67.93%, and my quarterly dividend is growing at an average rate of 2.28% without a single increase from STWD. One of the most enticing parts is that I am not reliant on STWD appreciating in price to have my overall investment appreciate in value. STWD is actually down -5.52% since my initial purchase, and I am up 58.66% in just under 6 years. I am continuing to add to my position in STWD in different accounts, and I can’t wait to see what this initial investment of 135 shares looks like in 2030.

Barbell Capital provides investors with a comprehensive approach that utilizes growth, value, dividends, and options for income, to generate alpha in your portfolio while mitigating downside risk. Within Barbell Capital you will find exclusive research, model portfolios, investment tools, Q&A sessions, watchlists, and additional features for its members. There is also a live portfolio dedicated to generating capital from trading, selling puts, and selling covered calls. The profits will be allocated to future capital appreciating investments and investing in dividend investments to generate income while we sleep. Join today with a two week free trial!

This article was written by

I am focused on growth and dividend income. My personal strategy revolves around setting myself up for an easy retirement by creating a portfolio which focuses on compounding dividend income and growth. Dividends are an intricate part of my strategy as I have structured my portfolio to have monthly dividend income which grows through dividend reinvestment and yearly increases. Feel free to reach out to me on Seeking Alpha or https://dividendincomestreams.substack.com/

Disclosure: I/we have a beneficial long position in the shares of STWD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters.