FG Trade

FG Trade

Healthcare real estate investment trusts, such as Ventas Inc. (NYSE:VTR), experienced an accelerating selloff last week, providing an opportunity for income investors to purchase a well-managed trust with strong recovery trends.

Ventas has a large and diverse real estate portfolio, with a focus on Senior Housing properties, and its dividend payout is easily covered by funds from operations.

Importantly, as a result of the recent selloff, the trust now provides income investors with a higher dividend yield and a more compelling valuation.

At the current stock price, I believe Ventas represents excellent value, and the dividend has room to grow.

Ventas is a large healthcare real estate investment trust that owns Senior Housing, Medical Offices, Life Science, and Skilled Nursing Facilities. The trust leases its properties to a group of mostly large operators who pay Ventas a monthly rent.

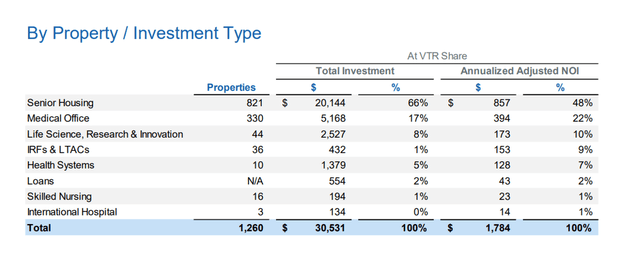

Ventas owned 1,260 properties as of June 30, 2022, the majority of which were related to Senior Housing (821). Medical offices were the second-largest category of healthcare assets (330). Ventas invested $30.5 billion in its real estate portfolio, and the trust’s real estate portfolio generates $1.8 billion in annual net operating income.

Investment Type By Property (Ventas)

Investment Type By Property (Ventas)

Ventas was hard hit by the Covid-19 pandemic because its businesses served the needs of the elderly, who are much more vulnerable to infection. Occupancy trends in Ventas’ Senior Housing business have deteriorated as a result of Covid-19, but conditions are gradually improving.

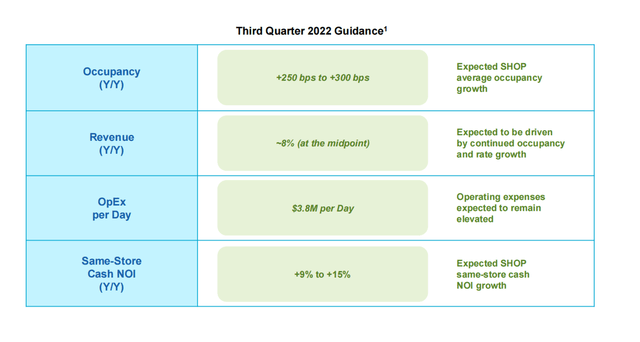

For the third quarter, Ventas expects 8% YoY revenue growth in the Senior Housing business and 9-15% net operating income growth on a same store basis.

Q3-22 Guidance (Ventas)

Q3-22 Guidance (Ventas)

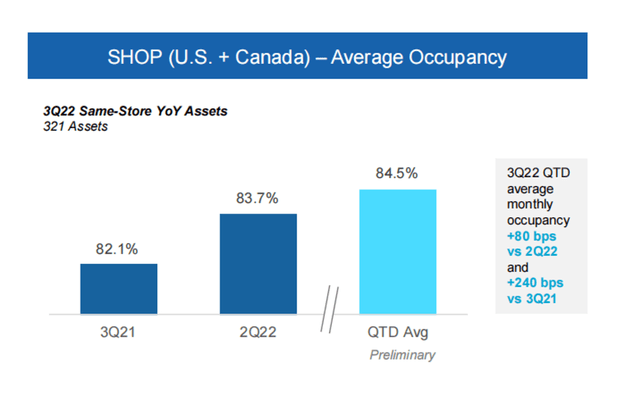

Ventas’ Senior Housing occupancy is improving, which is driving revenue and net operating income growth.

Average Occupancy (Ventas)

Average Occupancy (Ventas)

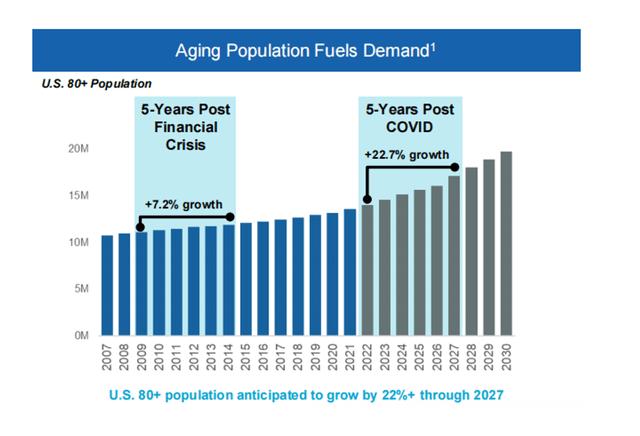

Long-term, the aging of the U.S. population, particularly among those aged 80 and up, is Ventas’ primary business driver. People aged 80 and up are a key demographic for Ventas and its operators, who provide a unique service offering. The population of people aged 80 and up is expected to grow rapidly in the coming years (+23% between 2022 and 2027), creating favorable demand dynamics for healthcare real estate investment trusts in general.

Fueled Demand By Aging Population (Ventas)

Fueled Demand By Aging Population (Ventas)

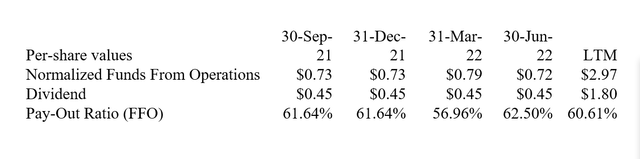

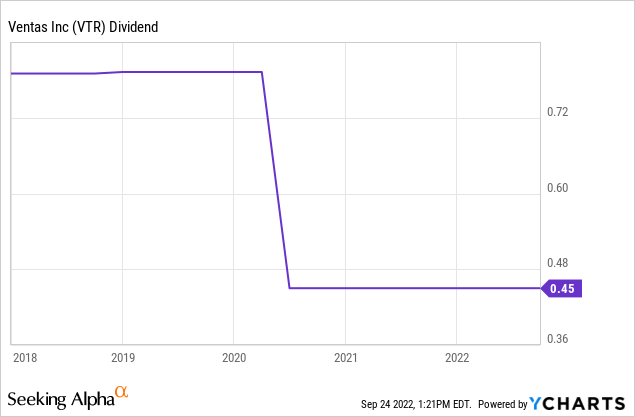

Ventas reduced its dividend from $0.7925 per share to $0.45 per share in 1Q-20 as a result of the global pandemic, which was especially hard on its Senior Housing business.

However, because the company is seeing improved occupancy trends, the chances of the real estate investment trust increasing its dividend payout in the future are increasing. Ventas has played it safe so far, paying out $0.45 per share per quarter in dividends, but there is room for growth.

Ventas paid out 63% of its (normalized) funds from operations in 2Q-22 and approximately 61% in the previous twelve months, indicating that the trust not only has a safe dividend, but that it can also grow.

Right now, I believe the trust will want to wait to see if the Senior Housing business continues to recover from the pandemic, but if occupancy and net operating income growth trends continue to point upward, Ventas may begin to increase its dividend pay-out again.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

As of right now, Ventas’ stock pays a $1.80 per share per year dividend that translates into a 4.1% dividend yield.

I believe Ventas can earn $3.00-3.10 per share in (normalized) funds from operations in 2022, implying 3-7% YoY growth.

The stock is trading at an FFO-multiple of about 14.2x based on$3.00-3.10 per share in funds from operations. Ventas traded at an FFO multiple of 17.7x two months ago, so the pullback, in my opinion, is a great opportunity to get into the healthcare trust at a lower price.

Ventas has successfully recovered from the Covid-19 pandemic, and the company appears to be on track for continued growth (given the Senior Housing guidance for 3Q-22).

However, a decline in occupancy and slower growth in rental revenue/net operating income may cause investors to take a more pessimistic short-term view of Ventas, even though long-term trends favor an investment in Ventas.

The Covid-19 pandemic has passed, and long-term aging trends, particularly in the 80+ population, are creating a positive outlook for Ventas and other senior-focused healthcare trusts.

The real estate investment trust covers its $0.45 per share dividend with funds from operations and has a pay-out ratio of around 60%.

While I do not believe the trust will increase its dividend in the near term, Ventas has the potential to do so in the long term.

Because of the stock price decline in Ventas, the trust’s 4.1% dividend is a good buy.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of VTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.