Feverpitched

Feverpitched

As most of my followers know, I have been writing on Seeking Alpha for over 12 years. I published my first article in 2010, and during that time I have written over 3,440 articles.

That’s a lot of words.

Back of the napkin, that translates into ~290 articles per year, or ~5.5 articles per week for ~12 years in a row,

I would have never imagined that I would become the most-followed writer on Seeking Alpha (with over 103,000 followers), but I suppose that I earned that prestigious award because of the dedication to writing.

That’s a long time for any writer to be pumping out content every single day, and to maintain the pace of quality, while always looking to uncover value within the REIT sector.

As many know, the “Great Recession” was the whole reason I’m now writing on Seeking Alpha.

Prior to 2010, I was a real estate developer in which I learned to concept of value creation literally from “the ground up.”

For over twenty-five years, I spent time in the trenches, learning how to generate value by developing stores for many national retailers, like Advance Auto (AAP), PetSmart, and Walmart (WMT).

Spartanburg Herald (May 18, 2002)

Spartanburg Herald (May 18, 2002)

My first experience in a recession was in 1990, where I was just getting started as a young developer, and then in 2001, where I was beginning to churn out stores for retailers.

Both recessions lasted around eight months in duration.

Then, in 2008, the big one hit. Of course, I’m referring to the “great” one.

Around that time, I was working with some regional homebuilders, who had become a dominant player in the local market (Greenville-Spartanburg). We had a separate commercial division in which I oversaw ground-up development.

I remember walking into my business partner’s office around November 2007, and he informed me that he was having to reduce overhead considerably and liquidate assets.

With around 500 houses in various stages of construction, the process was quite challenging, especially because the lenders weren’t cooperating. It was utter chaos, and for the next 18 months (until June 2009) it was extremely stressful.

I landed a job in late 2009, so that I could generate income, and I worked extremely hard to get back on my feet.

Then, in 2010 I landed on the Seeking Alpha website and wrote my very first article.

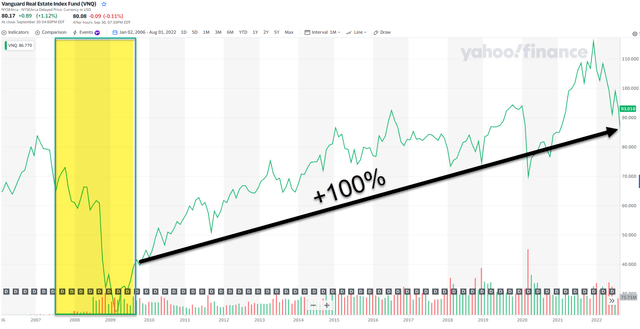

Then I wrote another one…and another… and before I knew it, I had written 3,400 articles. Interestingly enough, since I started writing on Seeking Alpha, real estate investment trusts (“REITs”) – as measured by Vanguard Real Estate ETF (VNQ) – have grown by around 107%.

Yahoo Finance

Yahoo Finance

Keep in mind, I used VNQ as the benchmark, which includes a broad basket of REITs, which are market-cap weighted.

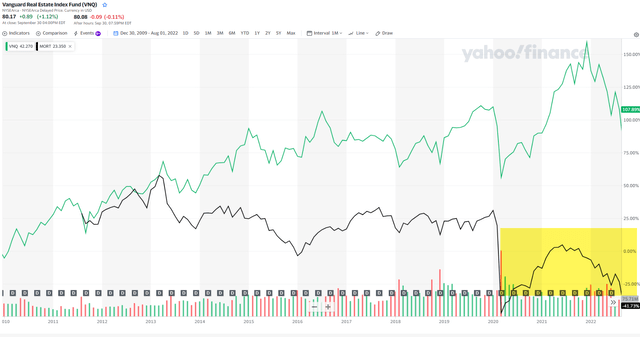

By comparison, here’s how the mortgage-focused VanEck Vectors Mortgage REIT Income ETF (MORT) has (under) performed (-41%):

Yahoo Finance

Yahoo Finance

A lot has changed over the last 12 years, most notably, the pandemic that all of us have experienced.

That’s what I call a “tipping point” if there ever was one.

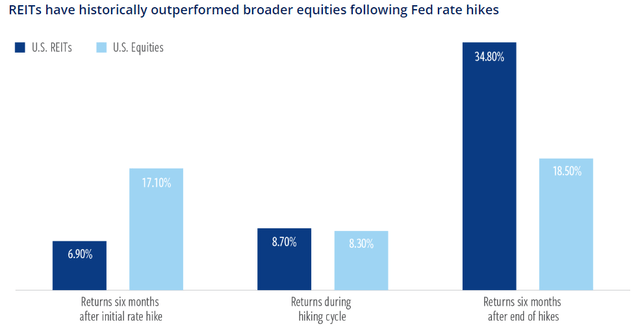

So, now another recession is knocking at our door. Some argue we’re in one now, and, of course, the question everyone is asking is how REITs will perform over the next few months or quarters.

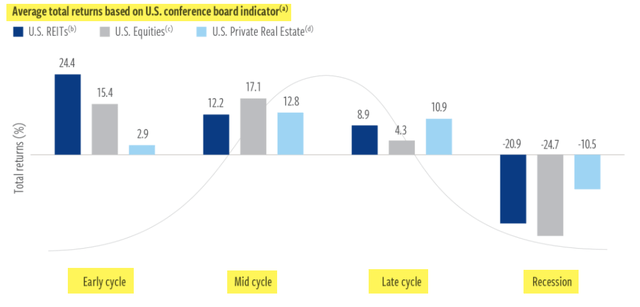

As Cohen & Steers explains:

“listed real estate tends to lead private real estate in both selloff and recovery during recessionary periods. Differences in the real-time pricing of listed REITs and private real estate can create significant short-term dislocations.

By understanding the leading and lagging behaviors of listed and private markets, real estate investors may be able to tactically allocate at different times across the two asset classes, seeking to take advantage of how markets have priced in current conditions.”

Cohen & Steers

Cohen & Steers

Cohen & Steers believes we’re in a recession, as:

“growth has slowed for consecutive quarters to start the year, and while jobs and some other measures still show strength, central banks have embarked on one of the most aggressive rate-hike paths in history, pushing rates higher to forcibly slow down the economy.”

The fund manager believes that we’re facing “an average recession,” as measured against recessions over the past 100 years. Their base case is “a decrease of 2% to 3% in real global domestic product and a duration of about 12 months.”

Notably, Cohen & Steers suggests that “superior returns in real estate tend to follow recessionary periods” and the result, emerging from this challenging period, “may be some strong vintage returns across both real estate categories.”

Importantly, “pricing real estate is challenging in an environment where growth rates are decelerating, and financing costs are still increasing.” Yet,

“…valuations in real estate prices, as well as further expected declines in some sectors, should present attractive entry points.”

Cohen & Steers

Cohen & Steers

So, as you see, Cohen & Steers is “expecting a strong vintage on the other side of the downturn.”

When I was actively developing commercial real estate, I was enamored with the REITs that enjoyed superior cost of capital, especially compared with “scrappy” real estate landlords like me.

It was simply impossible for me to go toe-to-toe with a REIT to acquire assets, so I strategically focused on development (something many REITs avoid) and smaller markets (where most REITs don’t go).

Of course, prior to the Great Recession it was easy to finance deals, so I generally invested minimal equity and relied on bank debt for funding. Does this sound familiar?

Many landlords have been focused on the availability of long-term cheap debt, so many could be soon faced with near-term loan maturities in which they could be forced to contribute equity to maintain control of their assets.

Otherwise, they may become forced sellers.

Now, for well-capitalized REITs, this creates an ability to generate opportunistic returns by acquiring assets on the cheap.

As I explained in my book, The Intelligent REIT Investor Guide:

“REIT investors became acutely aware of those risks in the Great Recession. During that period, over-leveraged entities were forced to sell properties whose values had dropped below the outstanding loan balance, often at deep fire-sale discounts. They then had to recapitalize and raise equity under very difficult market conditions.”

Green Street Advisors’ Mike Kirby, was quoted in a January 6, 2010, Wall Street Journal story:

“At its core, commercial real estate should be an income-oriented investment… when you over-lever, you take away those merits.”

Prudent financing strategy includes a firm commitment to maintain low leverage, mitigate refinancing risk by matching debt and asset maturity, rely on unsecured debt as a general rule, and manage interest rate risk using fixed-rate debt.

Debt markets will continue to tighten as rates rise and financial conditions worsen, and the strongest REITs should be able to take advantage of the opportunities this presents.

That’s why we will not be recommending REITs like Armada Hoffler Properties, Inc. (AHH) and Whitestone REIT (WSR). While their dividend yields may appear attractive, we consider these two REITs higher risk given their weaker balance sheet metrics and overall high cost of capital.

We prefer blue-chip REITs like Realty Income Corporation (O), Prologis (PLD), and Simon Property Group (SPG) – all A-rated REITs that heave earned premium pricing power because of their rock-solid balance sheets.

Prior to 2009, I had poor diversification.

For one, most of my net worth was due to my private real estate investments. These properties were mostly in SC, NC, and GA, and the majority of the income was derived from retail tenants.

I owned a few stocks, but I never really considered dividend income as part of my retirement. I was fixated on growing my net worth, and one huge mistake was that I was relying on highly leveraged income properties with no consideration of spreading my capital around.

Also, many of the properties I owned were in small markets, so when the recession hit, the tenants were hit much harder. I have visited many of the properties I once owned, and a majority of the original tenants have been replaced and some spaces remain vacant.

I learned the hard way that diversification is one of the most important risk management tools, and of course REITs offer tremendous potential for investors to spread their wealth.

These days, I have spread my wealth across many different property sectors including:

These days I own around forty REITs, that includes a few commercial mREITs, but I’m still not putting all of my hard-earned capital in one asset class. I’ve been spreading it around other income vehicles that includes BDCs, Midstream (MLPS), C-Corps, and ETFs.

Prior to the Great Recession, most of my real estate investments were held in LLCs in which I was not the managing member. This was a huge mistake.

While I did lose considerable equity because of the Great Recession, my toughest losses were a result of poor management. In 2003, I decided it was time for me to create a new chapter in my life and unwind my 15-year partnership.

What seemed simple, turned into a nightmare.

It took me over a decade to unwind the association, in which I lost millions of dollars due to mismanagement. I tried to unwind it quickly, but most of the LLCs had to be worked out (some were friendly, and some weren’t).

At some point, I was not getting K1’s for partnerships that were once valued at over $100 million. It was a tough lesson, and one in which I would not wish anyone.

So the word “trust” has special meaning to me when you recite the words – Real Estate Investment TRUST. In my new book (referenced earlier) I explain:

“I often tell people that, when you invest in a REIT, you’re not only placing your “bet” on the underlying real estate. You’re also putting your hard-earned money toward paying the “jockey” that’s running it for you.”

That’s so true!

I went on to explain,

“Remember that, as a shareholder in any company, you’re helping to pay its CEO’s, CFO’s, and CIO’s salaries. This means they owe you complete transparency regarding past earnings, acquisitions, or other pertinent information.”

That’s one of the primary reasons that I interview as many CEOs as possible. Recently I spoke with Ed Pitoniak, CEO at VICI, Paul Pittman, CEO at Farmland Partners (FPI), and Joey Agree, CEO of Agree Realty (ADC).

In around a week, I plan to meet with MPW’s CEO, Edward Aldag, and Starwood Property CEO Barry Sternlicht.

You can also see why I frown on external management and have no love for REITs like Global Net Lease (GNL). Alternatively, I’m happy to see pure-play ground lease landlord Safehold (SAFE) moving closer to the internalization process.

I save the best lesson for last.

When I was in college (a long time ago), I read The Intelligent Investor, authored by Benjamin Graham, but I never really grasped the margin of safety concept.

In his best-selling classic, Graham wonders what his reply would be if he were to distill the essence of sound investing into a single phrase. In his response to the self-directed challenge, he wrote three words, all in caps:

It wasn’t until 2009 that I dusted off the book and decided it was my time to become an intelligent REIT investor. I had basically gone through a nasty business partnership annulment and then the “Great” Recession, and it was time for me to make some big changes…a pivot!

So, after re-reading the book two or three times, I began pondering the concept of valuation, recognizing that my new habits of “forced conservatism” could provide me with a competitive advantage over other analysts and investors.

Ben Graham had experienced the Great Depression and he pointed out,

“The years of poverty since Father’s death had touched me only lightly. They had developed in my character a serious concern for money, a willingness to work hard for small sums, and an extreme conservatism in all my spending habits.”

So, I decided that I could help educate individual investors by continuously adhering to the lessons that I’ve learned from my missteps – namely, focusing on quality stocks, trusted management, diversification, and the margin of safety.

As I tell my close friends – who knew me before 2009 – the Great Recession (and preceding years) left a deep and lasting impression on me, much like the young Warren Buffett, who also experienced tough times:

“He emerged from those first hard years with an absolute drive to become very, very rich. He thought about it before he was five years old. And from that time on, he scarcely stopped thinking of it.”

Being broke is not fun, especially when you’ve enjoyed self-made wealth.

However, the Great Recession reshaped me into a highly determined investor with an instinctive understanding of value, with these words taped across my computer screen:

“Adversity is bitter, but its uses may be sweet. Our loss was great, but in the end, we could count great compensations.” Ben Graham:

Thank you for reading and commenting!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Banks, and we recently added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research (“WMR”), a subscription-based publisher of financial information, serving over 6,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha). Thomas is also the editor of The Forbes Real Estate Investor and the Property Chronicle North America.

Thomas has also been featured in Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox. He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, and 2019 (based on page views) and has over 102,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley).

Disclosure: I/we have a beneficial long position in the shares of AAP, ADC, AIRC, AMT, AVB, CCI, CTRE, DLR, EPRT, EQIX, FRT, FPI, GLPI, MAA, MPW, NTST, O, OHI, PLD, REG, SAFE, SPG, SRC, STAG, VICI, WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.